In today’s fast-paced and data-driven business landscape, managing expenses efficiently an securely has become a securely has become a cornerstone of financial success. As organisations grow and expenses multiply, the adoption of automated expense management systems is no longer just an option – it’s a strategic imperative. This article delves into the vital role of automation and security in expense management systems and how their synergy unlocks the true potential of modern business.

The Power of Automation

Automation is revolutionising the way businesses handle their expenses, streamlining processes, and optimising resource allocation.

But how?

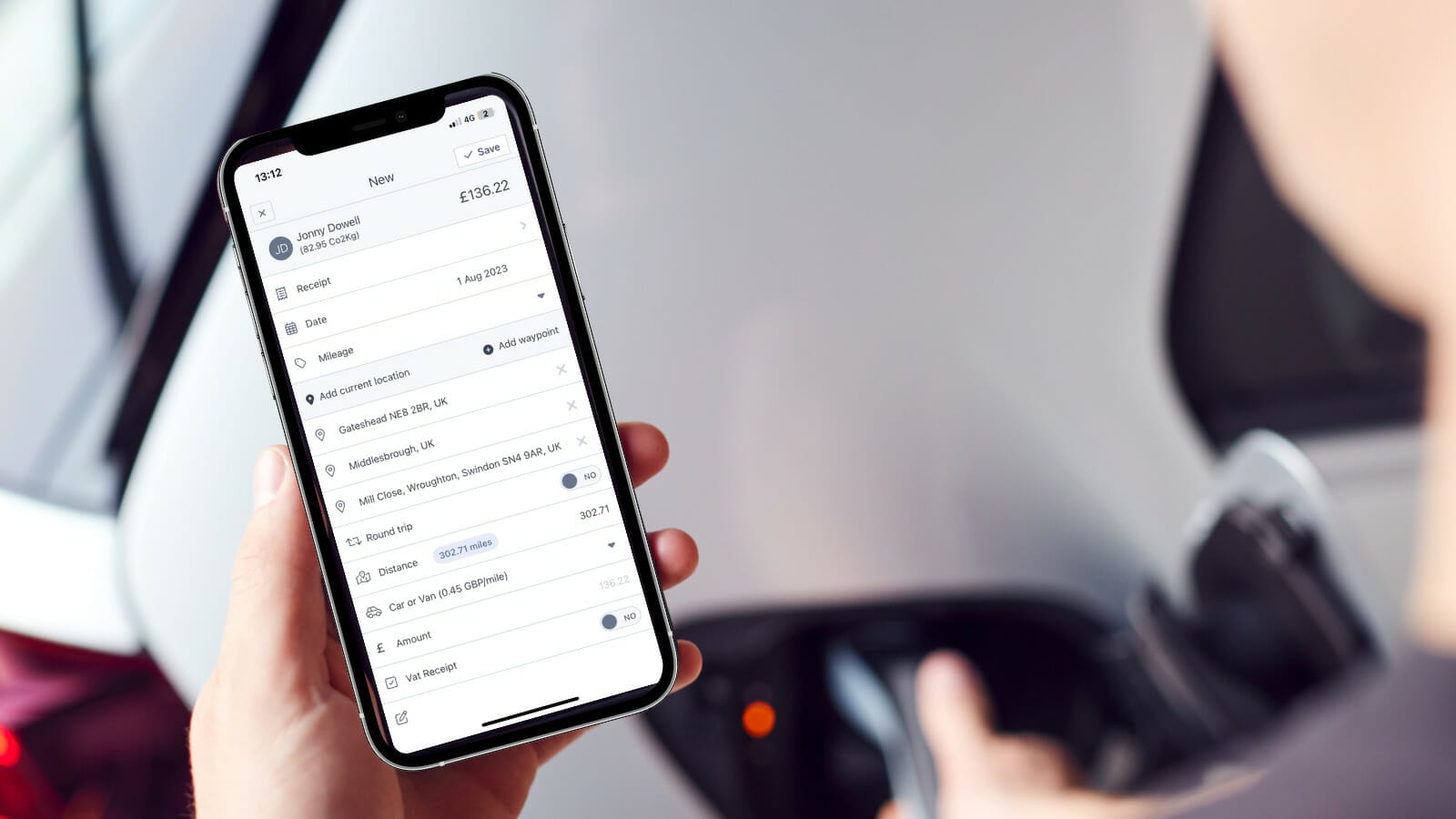

- Time and cost savings: Manual expense management is labour-intensive and prone to errors. Automation reduces human intervention, saving valuable time for employees and finance teams. It also curs down administrative costs, making expense management more efficient and cost effective.

- Eliminate bottlenecks and delays: An automated expense management system offers end-to-end automation, from receipt capture to reimbursement. It automates data entry, categorisation and approval workflows, eliminating bottlenecks and delays. With automation, managers can swiftly approve or reject them, leading to faster reimbursement cycles.

- Improved visibility: Automation provides real-time insights into expense data. Managers can monitor expenses as they occur, gaining a better understanding od spending patterns and making data-driven decisions. This visibility enables proactive financial management, helping businesses stay agile and responsive.

- Consistency: As businesses grow, manually managing expenses becomes more challenging. Automated systems scale effortlessly, accommodating a higher volume of expenses without sacrificing accuracy or consistency. This scalability ensures a seamless experience across different teams and departments.

- Integrations with Financial Systems: Automation allows seamless integration with other financial systems, such as accounting software or ERP solutions. This integration ensures data consistency and eliminates the need for duplicate data entry, reducing the risk of errors.

The Critical Role of Security

Expense management involves sensitive financial data and personal information, making security a paramount concern.

Here’s why robust security measures are essential:

- Data Protection: Automated systems must comply with data protection regulations to safeguard sensitive financial data and employee information. Robust security measures, like encryption and access controls, ensure compliance with GDPR, CCPA, and other data privacy laws.

- Fraud Prevention: Expense management systems are vulnerable to fraudulent activities, such as inflated expenses or duplicate claims. Advanced security features, such as inflated expenses or duplicate claims. Advanced security features, such as AI-powered fraud detection algorithms, can flag suspicious expenses and prevent financial losses.

- Role-based Access Controls: Implementing role-based access controls ensures that only authorised personnel can access sensitive data. This mitigates the risk of unauthorised data exposure and internal data breaches.

- Secure Receipt Handling: Automating receipt capture and storage must be coupled with secure cloud storage and data encryption. This protects against data loss and ensures that receipts are accessible only to authorised personnel.

The Synergy of Automation and Security

The true potential of expense management systems is realised when automation and security are united. By combining streamlined processes with robust security measures, businesses can:

- Maximise Efficiency: Automated systems accelerate expense management workflows, reducing processing times and costs.

- Enhance Accuracy: Automation minimises human errors, leading to accurate financial reporting and decision making.

- Ensure Compliance: Strong security measures protect against data breaches, safeguarding both financial and personal information.

- Empower Innovation: With manual tasks offloaded to automation, employees can focus on strategic initiatives, driving business innovation.

In Summary

In conclusion, adopting an automated expense management system fortified with robust security measures is no longer a luxury but a necessity for modern businesses. By leveraging the synergy of automation and security, organisations can unlock their true potential, driving growth, and staying ahead in today’s competitive landscape.

Embrace the power of automation and security today, and witness the transformative impact on your expense management processes. Get in touch.