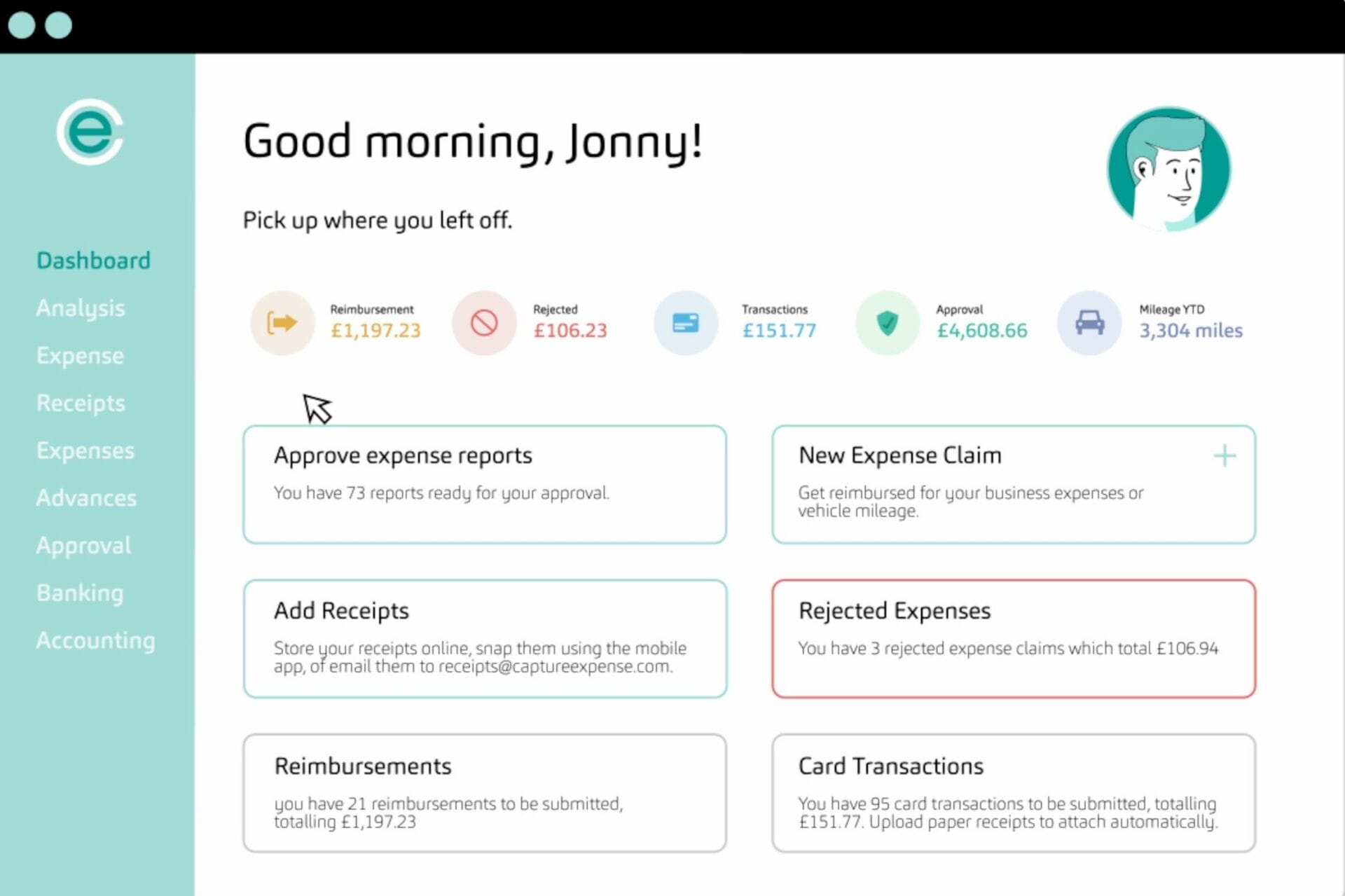

Scan Expense Receipts in Seconds

Automate your receipts and expenses with Capture Expense. Our receipt scanner extracts your team’s spend data in real-time and automatically generates expenses—so you don’t have to.

Intelligent brands taking total control of company spend

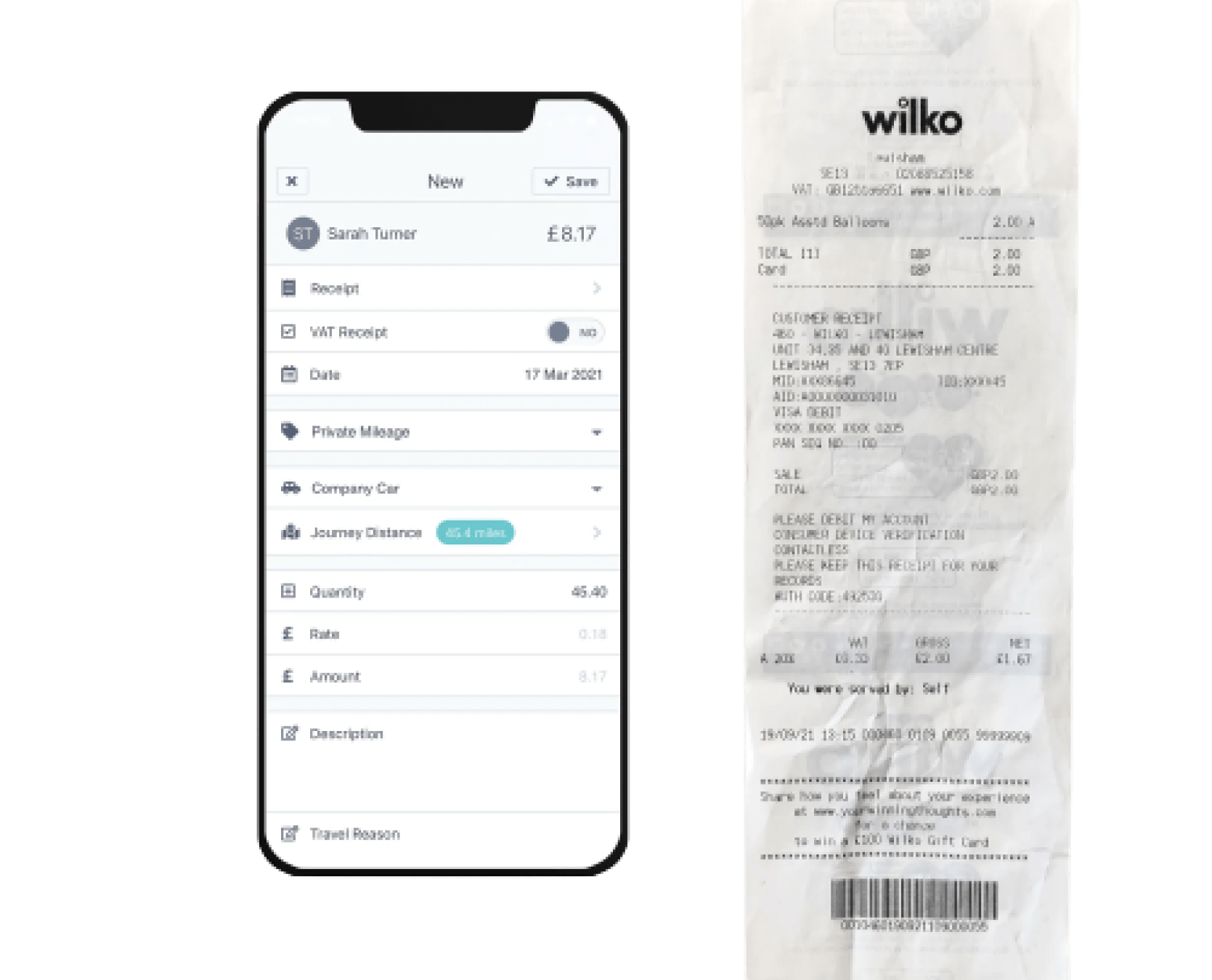

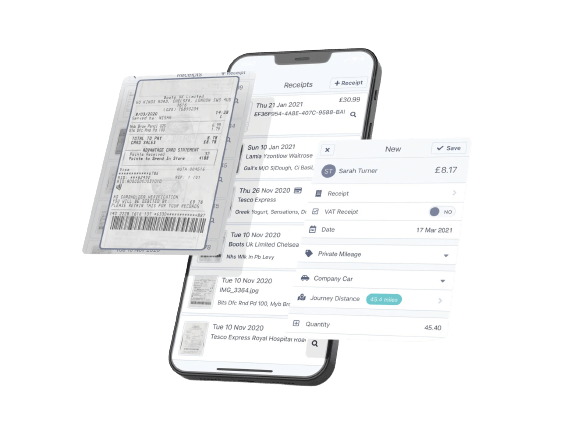

The ultimate app for expense receipts, available anywhere, anytime

Fully accessible on any device, at any time, from any location. The Capture Expense receipt scanner enables your teams to snap their receipts in seconds from the very moment of spend.

Intelligent automation then generates expenses by extracting receipt data, so you don’t have to type a thing. That’s less receipts lost, less paper processes, and less time spent chasing.

How does the receipt scanner work?

1

Open the app

Your teams open the Capture Expense app on-the-go, no matter their device or location.

2

Snap the receipt

Then they simply snap a photo of their receipt through the app, which automatically extracts the data.

3

Submit the expense

The data from the scanned receipts automatically generates expenses, ready for your teams to submit straight away.

Capture Expense Brochure

Unlock the power of real-time spending insights across your entire organisation. Dive into our brochure to discover how you can stay on top of reimbursements, bills, and credit card transactions as they happen, ensuring smarter financial decisions.

Receipts and expenses powered by automation

The Capture Expense app uses sophisticated software to automatically extract the data from your expense receipts so you don’t have to type a thing, giving you real-time data capture and instant accuracy.

Then, all the data from your scanned receipts is stored in-platform and automatically included in all your expense reports—streamlining your once-paper processes from beginning to end.

Customisable and automatic receipt categorisation

Automatically categorise receipts and expenses based on your organisations own expense categories—and set different spend policies to each individual category so you’re never exceeding your spend budget.

Make sure every scanned receipt goes into the right report, so you have an accurate overview of costs. And Capture Expense will scale with your business with unlimited cost centres and multi-level approvals.

The support we have received has been fantastic; we always receive a prompt and professional response with answers to any queries we may have. It is apparent how important it is to the team to continually improve Capture Expense and any feedback provided by us has been taken on board and almost always implemented for the best possible service.

– Business Systems & Procedures Supervisor

Upload, store, and archive scanned receipts

Your receipt scanner will automatically store receipts in the archives section of the app, so your employees can see all their historical spend and your finance teams can gain a view of the whole organisation.

While they’re safely stored in the app, they’ll also be backed-up by our servers for a set period of time in line with government policies, so data is safe and accessible.

Why choose Capture Expense?

Total expense accuracy

Whether it’s pre-populated receipt data or automated mileage calculations, you’ll significantly improve the accuracy of your spend data.

All-in-one spend

By centralising your reimbursements, bills, and credit card transactions, you not only avoid the hassle of lost receipts but also significantly minimise paper-based tasks.

24/7 on mobile or desktop

Capture Expense is available on any device, at any time from any location. Its responsive layout means it adapts to every size of screen whether desktop, laptop or tablet.

Expense receipts FAQ’s

How long do I need to keep business expense receipts?

In the UK, it’s generally recommended to keep business expense receipts for at least 5 years for tax purposes. This duration ensures compliance with HM Revenue & Customs (HMRC) guidelines and allows for any potential audits or inquiries. However, specific circumstances or industries may warrant longer retention periods.

Not in the UK? In general, it’s advisable to keep receipts for at least three to seven years for tax purposes. However, certain expenses, such as those related to assets or investments, may require longer retention periods. It’s always best to consult with a tax professional or accountant for specific guidance tailored to your business and location.

Can I keep expense receipts digitally?

In the UK, HM Revenue & Customs (HMRC) accepts digital copies of receipts as long as they are accurately recorded and stored in a manner that maintains the integrity and readability of the original document. This means that scanned or photographed copies of receipts are generally acceptable, provided they are legible and contain all the necessary information (such as the date, amount, supplier details, and nature of the expense). Capture Expense offers you reliable and secure digital receipt storing.

If you’re not based in the UK, the requirements for storing business expense receipts may vary depending on the regulations of the country or jurisdiction where your business operates. Many countries have similar guidelines to the UK, allowing for digital storage of receipts as long as certain criteria are met to ensure the integrity and accuracy of the records.

Does the receipt scanner work for multiple currencies?

Yes, Capture Expense works in multiple different currencies. That includes historical and real-time exchange rates, so you can take Capture Expense overseas while simplifying your transactions and reducing foreign exchange costs with regional billing. Read more about our global capabilities over on our global expense management page.

Do I need a VAT receipt to claim expenses?

In many cases, you do not necessarily need a Value Added Tax (VAT) receipt specifically to claim expenses. However, having a VAT receipt can be beneficial for businesses registered for VAT as it provides evidence of the VAT paid on the expense. This allows you to reclaim the VAT as input tax if it’s related to taxable supplies for your business. For expenses to be eligible for reimbursement or tax deduction, what’s generally required is a valid receipt or document that provides details of the expense, including the date, amount, supplier/vendor details, and description of the goods or services purchased.

How much does Capture Expense’s receipt scanner cost?

Capture Expense offers a variety of pricing plans to suit different business needs. We provide a two-week free trial, allowing you to explore our platform’s features and benefits. In addition to the free trial, we offer business and enterprise pricing plans, each tailored to specific requirements. These plans come with various features and scalability options to accommodate organisations of different sizes and complexities. Visit our pricing page to learn more.

Extra features for your receipts and expenses

Reimbursements

Easily approve and manage reimbursements in Capture Expense, syncing data with finance and payroll for total ease.

Corporate Card Reconciliation

Keep all your business expenses in one place with Open Banking integrations, for a real-time window into all company spend.

Vehicle Mileage

Never miscalculate mileage again with Capture Expense’s smart automation, for accurate tax reclaims every time.