The Mileage Tracking App for Efficient Business Miles

Get everything you need to ensure accurate tax reclaims, every time, with the ultimate business mileage tracker in Capture Expense—with precise distance calculation and expert vehicle advisory rates.

Intelligent brands taking total control of company spend

The mileage tracking app that manages everything for you

Accurate tax reclaims

Maximise your tax reclaims with built-in vehicle-specific tax elements in our business mileage tracker, or tailor your own custom rates for a personalised tax experience.

Reduced fraudulent claims

Manual adjustments to the calculated distance are tracked to reduce fraudulent claims, improving the accuracy of your business mileage reimbursements and cutting your costs.

Approved fuel rates

Benefit from HMRC-approved and advisory fuel rates for both corporate and personal vehicles included in the app as standard, so you’re always fully compliant.

Capture Expense Brochure

Unlock the power of real-time spending insights across your entire organisation. Dive into our brochure to discover how you can stay on top of reimbursements, bills, and credit card transactions as they happen, ensuring smarter financial decisions.

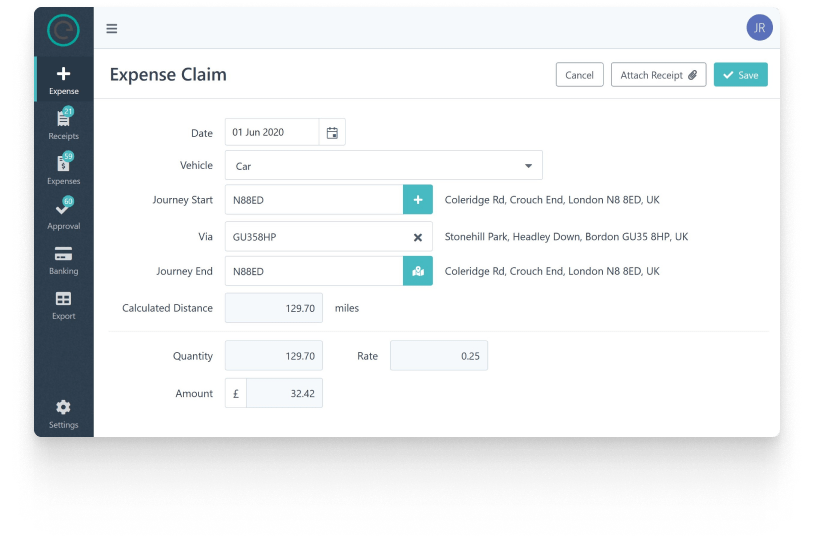

Automated mileage calculations, accurate business mileage reimbursements

Automate your team’s business journeys with Capture Expense’s distance calculator.

Create seamless and accurate travel logs as our powerful APIs record journeys and distance on your team’s behalf—so you know your business mileage claims are as accurate as possible when removing the risk of human error.

Monitor your team’s mileage emissions with carbon tracking

In your mileage tracking app, you’ll get access to comprehensive reports on the carbon emissions generated during your team’s journeys.

You can use your carbon tracking data to make greener decisions on travel, reduce your carbon footprint, and contribute to more sustainable business travel.

The implementation of Capture Expense’s streamlined approval process has been a game-changer for us. It’s made our previously complex workflow incredibly smooth and efficient. The platform’s capabilities have saved us time and effort, allowing us to focus on what truly matters.

– Project Leader

Business mileage tracker, powered by Google

Our platform makes mileage tracking effortless by tapping into Google’s smart technology. The seamless integration simplifies the mileage tracking process for your users, eliminating the need for manual calculations or guesswork.

By integrating with Google, you can have confidence in the accuracy and reliability of your expense claims. It’s a hassle-free solution that streamlines your mileage claims and ensures peace of mind.

Mileage tracking FAQ’s

What does HMRC class as business mileage?

HMRC defines business mileage as any mileage travelled as part of your job duties or business operations. This typically includes journeys directly related to work, such as:

- Travel between different work locations (e.g., between offices, sites, or client locations).

- Travel to meet clients or attend business meetings.

- Travel to attend training courses or conferences related to your job.

- Travel for work-related deliveries or collections.

- Travel to temporary workplaces, if the journey is necessary for your work.

Commuting from your home to your regular place of work is generally not considered business mileage by HMRC, as it’s seen as personal travel.

Can I claim VAT on business mileage?

In the UK, VAT (Value Added Tax) can generally not be claimed on business mileage for most types of vehicles. The reason is that mileage expenses for vehicles are typically reimbursed using the HMRC-approved mileage rates, which already include an element to cover VAT.

However, if you’re using a leased or hired vehicle where you pay VAT on the lease or hire charges, you may be able to reclaim the VAT on those expenses, subject to certain conditions. And if you’re using a vehicle exclusively for business purposes and you’re VAT registered, you may be able to claim VAT on the fuel costs associated with that vehicle.

What is the business mileage rate for 2023?

For the first 10,000 miles in the tax year, per mile:

- Cars and vans: 45p

- Motor cycles: 24p

- Bicycles: 20p

Each business mile over 10,000 in the tax year:

- Cars and vans: 25p

- Motor cycles: 24p

- Bicycles: 20p

A mileage tracking app, like Capture Expense, will have these rates pre-built into the platform so you can automate your mileage calculations and never worry about inaccurate mileage claims again.

What is the approved mileage allowance payment?

The ‘approved amount’ for mileage allowance payments is any amount paid to employees for mileage that is within the business mileage rates outlined in the previous question.

Anything above the ‘approved amount’ in your business mileage reimbursements must be treated as additional income and will be subject to tax and other deductions as normal.

Anything below the ‘approved amount’, you do not have to report to HMRC or pay tax.

How long should I keep records of business mileage?

It’s recommended to retain records of business mileage for at least 6 years for tax purposes, in accordance with HMRC guidelines. This ensures that you have documentation to support any claims or deductions in the event of an audit or inquiry.

Your data will be safely stored in our mileage tracking app, they’ll also be backed-up by our servers for a set period of time in line with government policies, so data is safe and accessible.

Extra features alongside your business mileage tracker

Reimbursements

Easily approve and manage reimbursements in Capture Expense, syncing data with finance and payroll for total ease.

Corporate Card Reconciliation

Keep all your business expenses in one place with Open Banking integrations, for a real-time window into all company spend.

Receipt Scanning

Enable your teams to snap and send receipts on-the-go, automatically creating and raising expenses.