In today’s dynamic business environment, companies of all sizes are constantly seeking ways to optimise their operations and improve their bottom line. One often overlooked aspect that can significantly impact a company’s ROI is expense management. Traditional manual expense processes are not only time-consuming but also prone to errors.

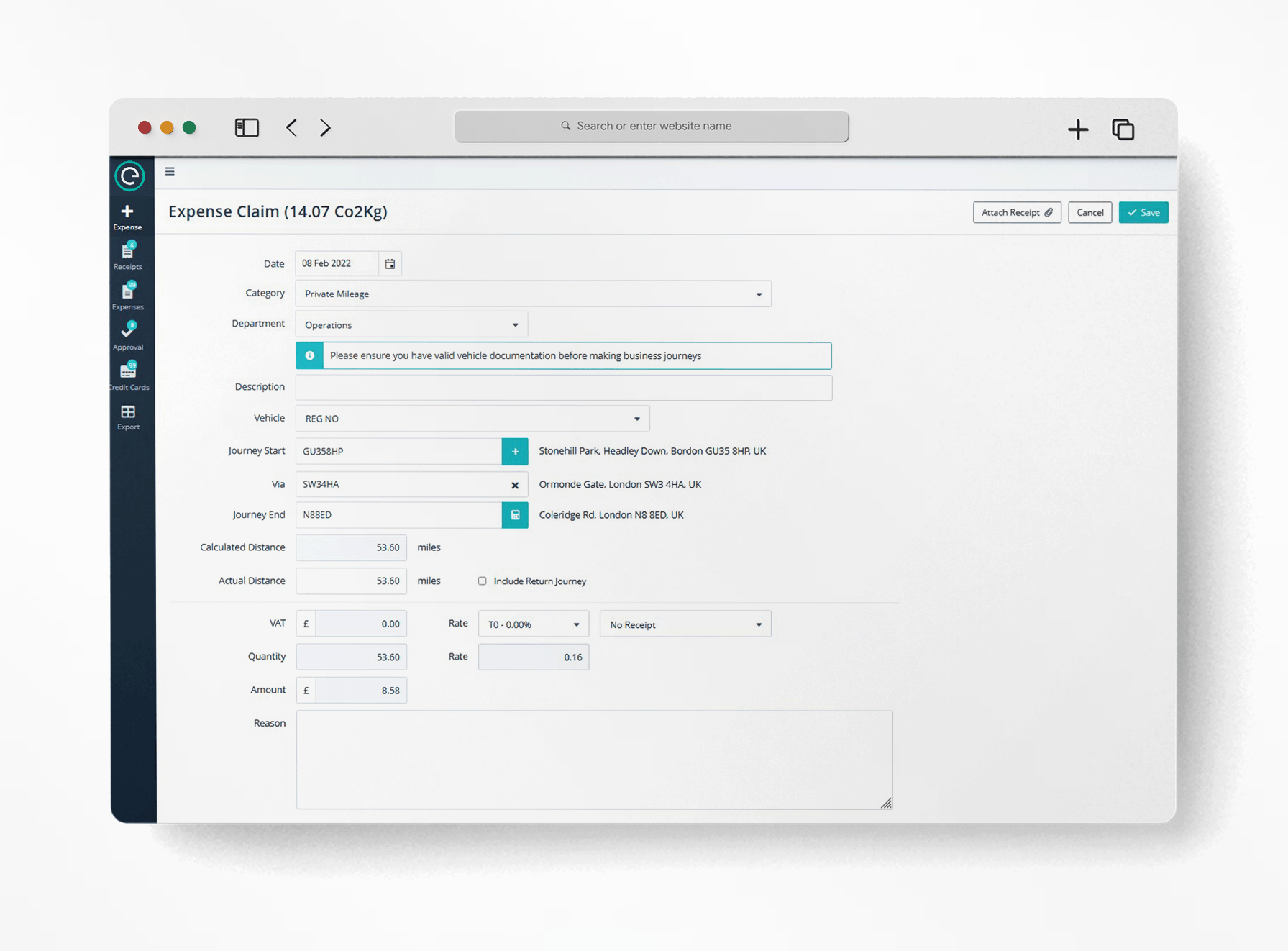

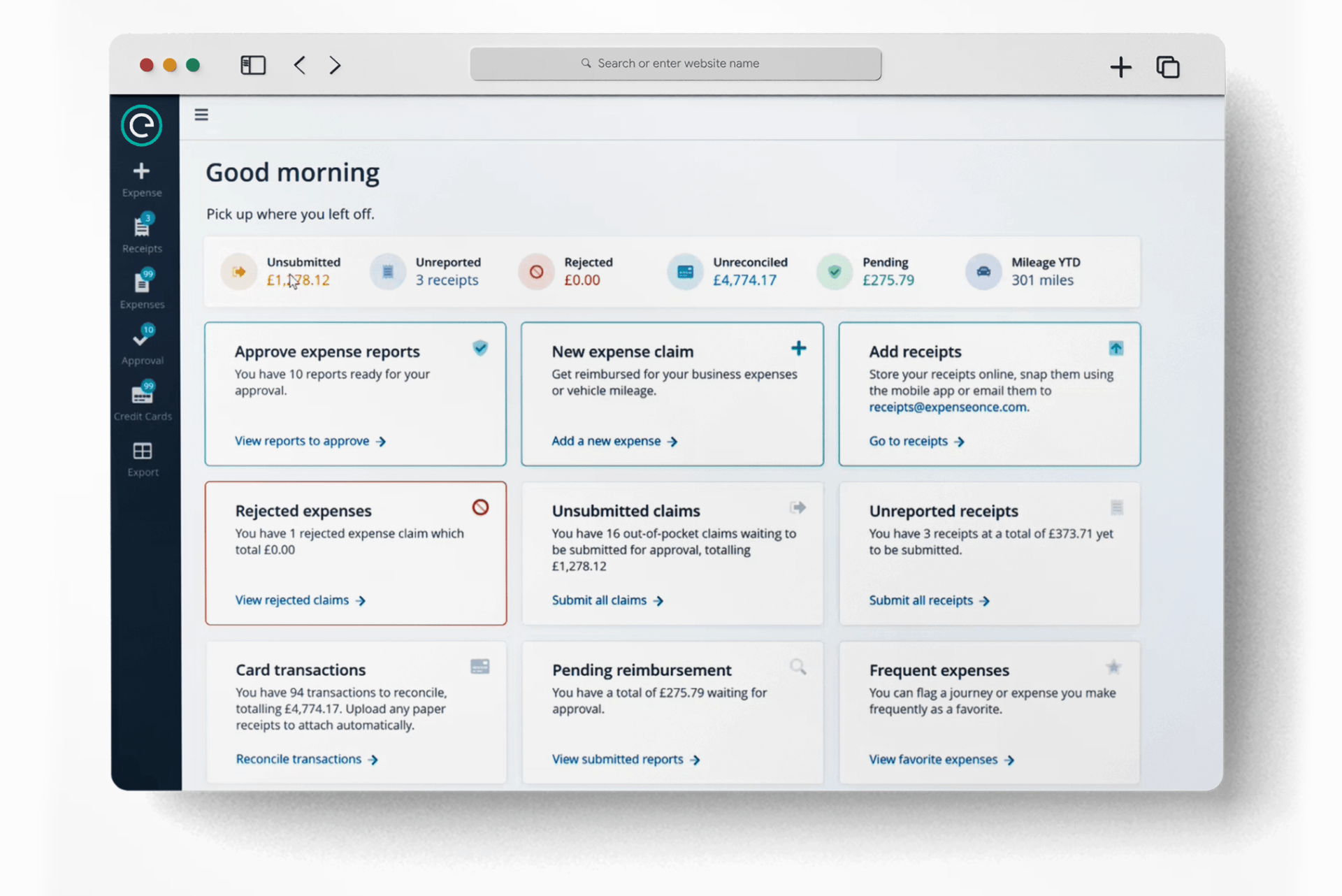

However, with the advent of expense management solutions like Capture Expense, companies can revolutionize their expense management practices and unlock numerous benefits that directly impact their return on investment (ROI).

In this blog post, we will explore how expense management solutions can boost a company’s ROI, backed by facts and figures.

1. Time Efficiency and Productivity:

According to a study by the Aberdeen Group, companies using automated expense management solutions reduced the time spent on processing expenses by an average of 67%. This time-saving translates into increased productivity for employees, including finance teams and other stakeholders involved in expense management. By streamlining and automating the entire expense process, from capturing receipts to reimbursement, companies can focus their valuable resources on core business activities, driving productivity and ultimately boosting ROI.

2. Cost Savings:

Expense management solutions offer significant cost savings potential. For instance, a report by the Global Business Travel Association (GBTA) found that companies can save an average of 10-12% on their travel and entertainment expenses by implementing an automated expense management system. This cost reduction is primarily driven by eliminating manual processes, reducing errors, and enabling better expense control and policy compliance. Moreover, expense management solutions help identify areas of excessive spending and highlight cost-saving opportunities, further contributing to increased ROI.

3. Fraud Prevention and Compliance:

Expense fraud can have a substantial negative impact on a company’s financial health. According to the Association of Certified Fraud Examiners (ACFE), expense reimbursement fraud accounts for approximately 14% of all fraud cases reported. Expense management solutions play a crucial role in combating fraud by implementing robust controls and automated approval workflows. By leveraging AI-powered algorithms and machine learning, these solutions can detect suspicious patterns and flag potential fraudulent activities, ultimately safeguarding company assets and enhancing compliance. Mitigating expense fraud not only protects the company’s bottom line but also enhances its reputation and trustworthiness, positively impacting ROI.

4. Data Analytics and Insights:

Expense management solutions provide companies with access to a wealth of data that can be leveraged to gain valuable insights. These solutions offer comprehensive reporting capabilities, allowing companies to analyse spending patterns, identify cost-saving opportunities, and optimize their expense policies. According to a report by Certify, companies that utilize expense management solutions with advanced analytics features can achieve an average of 46% greater compliance with their travel and expense policies.

These insights enable companies to make data-driven decisions, allocate resources effectively, negotiate better vendor contracts, and drive overall financial performance, leading to improved ROI.

5. Integration and Scalability:

Modern expense management solutions seamlessly integrate with other business systems like accounting software, HR systems, and ERP platforms. This integration eliminates manual data entry, reduces errors, and ensures data consistency across different departments. Moreover, as companies grow, expense management solutions can easily scale to accommodate increasing expense volumes and support expanding teams, resulting in improved operational efficiency and a higher ROI.

In Summary:

Expense management solutions, such as Capture Expense, have proven to be invaluable tools for companies seeking to boost their ROI. By automating and streamlining expense processes, these solutions save time, reduce costs, prevent fraud, provide valuable insights, and seamlessly integrate with existing systems.

The facts and figures presented highlight the tangible benefits that companies can achieve by adopting such solutions. Embracing expense management solutions is not only a strategic move but also a smart investment that can yield significant returns, enhancing the overall financial health and success of an organization.

If you’d like to have a chat and see how we can take the hassle out of Expense Management, just get in touch. Book a Capture Expense demo and see how it can work for you.