As businesses strive to adopt sustainable practices and reduce their environmental footprint, tracking and managing CO2 emissions and mileage rates have become an essential aspect of expense management. Traditional expense tracking methods often lacked visibility into carbon emissions and vehicle mileage, making it challenging for organisations to accurately assess their environmental impact. However, with the advent of advanced expense management systems, companies can now gain valuable insights into their carbon footprint and optimise their transportation practices for a greener approach.

Why should my organisation factor CO2 and mileage rates into our expense reports?

1. Environmental Responsibility

Including CO2 and mileage rates in company expenses represents a commitment to environmental responsibility. By tracking and accounting for the carbon footprint generated by business operations, organisations can identify areas where they can reduce emissions. This transparency helps to set realistic targets for sustainability initiatives and encourages employees to adopt greener practices in their day-to-day activities.

2. Enhanced Public Perception and Brand Image

Incorporating CO2 and mileage rates in expenses sends a strong message to customers, investors and other stakeholders. Demonstrating that the company values sustainable practices and is actively working to reduce its environmental impact. Such actions enhance the brands image, attract environmentally conscious consumers and can even sway investors towards supporting a more eco-friendly business.

Moreover, companies that take sustainability seriously are often more attractive to potential partners and collaborators. Including CO2 and mileage rates in expenses can create common ground when seeking partnership opportunities.

3. Legal Compliance and Reporting

As governments continue to implement stricter environmental regulations, businesses face increasing pressure to comply with sustainability reporting requirements. By integrating CO2 and mileage rates into their expense tracking systems, companies can easily gather the data needed for accurate and timely reporting. This proactive approach not only ensures legal compliance but also establishes a culture of transparency and accountability within the organsiation.

4. Cost Savings and Efficiency

Implementing CO2 and mileage rates in expense tracking can lead to long-term cost savings. By monitoring and optimising travel and transportation expenses, companies can identify opportunities to reduce fuel consumption, streamline routes, and minimise overall mileage.

So, how can I track CO2 emissions?

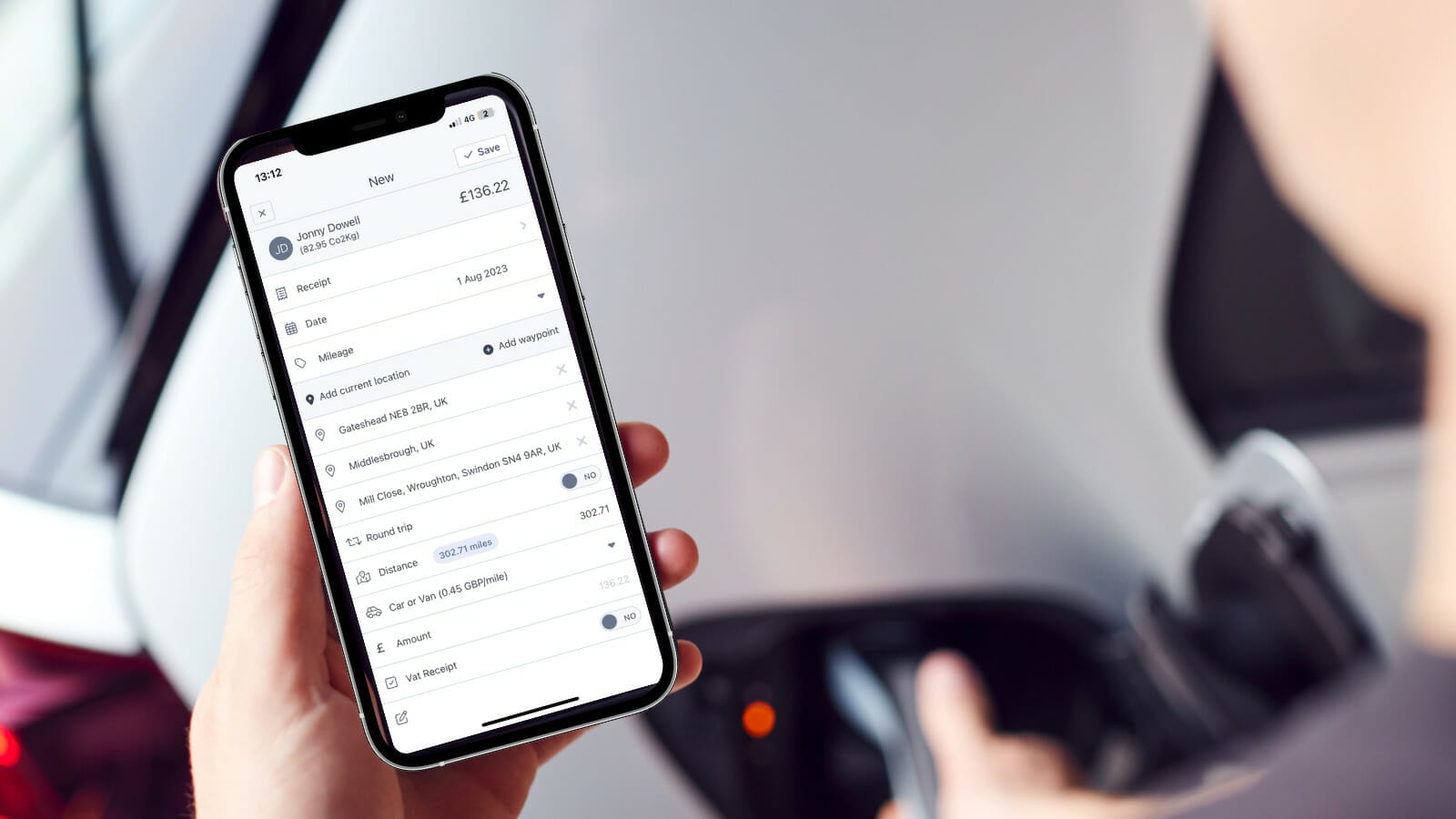

Using Integrated Data Collection expense management systems, like Capture Expense, seamlessly integrate with various sources and company vehicle data. This integration enables the capture of essential data, including fuel consumption, transportation modes and distances travelled.

Sophisticated Emission Calculation Algorithms accurately calculate CO2 emissions based on the collected data. These algorithms consider factors such as vehicle type, fuel efficiency, distance travelled and transportation mode (air, road, rail, etc.) providing precise emissions data.

From there, the expense management system generates comprehensive reports and analyses, breaking down emissions data across different departments, projects or individuals. This data empowers organisations to identify areas where emission reduction efforts can be most effective.

And mileage rates?

By integrating with organisations like Google Maps, Capture Expense automatically tracks the distances travelled by employees using company vehicles or personal cars for work-related purposes. This eliminates the need for manual input, reducing the likelihood of errors.

With mileage data at their disposal, the system calculates reimbursement amounts based on pre-defined mileage rates or government-set-tax-deductible rates. This automation streamlines the reimbursement process for employees and simplifies compliance for businesses. Capture Expense deploys this by automatically updating the approved mileage rates in accordance with the HMRC.

What are the benefits?

Environmental Impact Awareness: By accurately tracking CO2 emissions, businesses gain a comprehensive understanding of their carbon footprint. Allowing emission reduction targets to be set as part of their sustainability initiatives.

Cost Savings: Efficient mileage tracking ensures businesses comply with tax regulations and claim eligible tax deductions for employee travel expenses.

Data-Driven Decision Making: The data obtained from expense management systems empowers organisations to make informed decisions, such as promoting carpooling or investing in eco-friendly vehicles.

In Summary

Expense management systems have evolved into indispensable tools for businesses seeking sustainability. By tracking CO2 emissions and mileage rates, organisations can reduce their carbon footprint, optimise travel expenses, and contribute to a greener future.

Embracing these systems not only benefits the environment but also enhance operational efficiency and demonstrates a commitment to corporate social responsibility. In the pursuit of a sustainable future, expense management systems offer a powerful ally for businesses to drive positive change.