Getting your head around the nuances of travel expenses in Ireland can be tricky. It’s like trying to find your way through Dublin for the first time without Google Maps—confusing, frustrating, and if you’re not careful, it could end up costing you more than it should.

But don’t worry, if you’re an employer in Ireland looking to reimburse your team for work-related travel, you’re in good hands.

We’ll outline what qualifies as a travel expense in Ireland, when you can reimburse your employees, and how to report it to Revenue.

What’s a travel expense in Ireland?

Travel expenses in Ireland refer to the costs incurred by an individual or business for work-related travel. These expenses can include:

- Transport costs (e.g., fuel, mileage for personal vehicle use, public transport fares, taxis, flights)

- Accommodation (e.g., hotel stays for business trips)

- Subsistence (e.g., meals and incidental expenses while travelling for work)

- Tolls and parking fees

For employees, travel expenses may be reimbursed by employers or claimed as allowable expenses for tax purposes, subject to Revenue’s guidelines.

Reimbursement may be based on actual costs incurred or standard mileage/subsistence rates set by Revenue.

When can you reimburse your employees for their travel expenses in Ireland?

You can reimburse your employees for travel expenses when they travel for work and the expense is incurred wholly, exclusively, and necessarily for business.

This includes covering costs like transport, accommodation, and meals if they have to stay away from their usual workplace. If they use their own car, motorcycle, or bicycle for business travel, you can also compensate them based on mileage rates (see below).

A quick example

If one of your sales representatives needs to visit multiple client sites across the country, you can reimburse their train fares, hotel stays, and meals.

Similarly, if an employee drives their own car to attend a conference on behalf of the company, you can cover their fuel costs based on the approved mileage rate.

Get the latest insights and product updates, direct to your inbox.

How to calculate the distance of a business trip in Ireland

To work out how far your employees travel for work, you’ll need to use the lower of either:

- The distance between your employee’s home and the temporary place of work.

- The distance between your employee’s normal place of work and the temporary place of work.

A real–world scenario

Let’s say one of your employees (Carly) normally works in Dublin city centre but has to travel to Cork for a meeting.

- The distance from Carly’s home in Bray to Cork is 250 km.

- The distance from her normal office in Dublin to Cork is 220 km.

Since the Dublin to Cork route is shorter, that’s the distance used for her travel calculation.

The travel and subsistence rates in Ireland for 2025

Now you know the when and how to reimburse your employees’ travel expenses in Ireland, let’s look at the how much.

Thankfully, Revenue have set very clear guidelines when it comes to travel and subsistence in Ireland.

Travel

As we mentioned above, you can reimburse your employees for using their personal vehicles for business journeys. Don’t forget, this doesn’t include commuting from home to their normal place of work.

You have the option to either reimburse the actual travel expenses incurred by the employee or provide a fixed mileage allowance per kilometre.

Here are the civil service mileage rates for 2025.

Subsistence

When it comes to reimbursing your employees for subsistence expenses, you have three options:

- Apply the civil service rates: this is the simplest option. You can reimburse your employees using the official civil service subsistence rates set by Revenue. These rates are pre-approved and tax-free.

- Set your own rates: alternatively, you can choose to set your own reimbursement rates, but they must not exceed the civil service rates.

- Reimburse actual expenses: another option is to reimburse your employees for the exact costs they incurred during their trip.

What you need to know about ERR

Since January 1, 2024, new payment reporting rules, known as Enhanced Reporting Requirements (ERR), have come into effect. Here’s what you need to know:

These rules, introduced under Section 897C of the Finance Act 2022, are designed to improve transparency in how businesses handle certain expenses. However, they also bring some compliance challenges that you’ll need to be aware of.

What needs to be reported

You’ll need to report specific details about certain payments made to your employees:

- Small benefit exemption: you need to record the date the benefit was given and its value.

- Remote working daily allowance: report the total number of days covered, the amount paid, and the payment date.

- Travel & subsistence payments: for each payment, record the amount and date paid, under these categories:

- Travel (both vouched and unvouched)

- Subsistence (both vouched and unvouched)

- Site-based employees (including ‘country money’)

- Emergency travel

- Eating on-site

How do you report it?

You must submit these details to Revenue at the time of payment or even before it’s made.

Reports should be submitted via the Revenue Online Service (ROS), either manually or through your accounting/ERP software.

Are you looking for a platform that can handle all your travel expenses in Ireland?

With just a few taps, you can capture receipts, automate employee reimbursements, and effortlessly manage all your travel expenses in Ireland. Book a demo today to see Capture Expense in action.

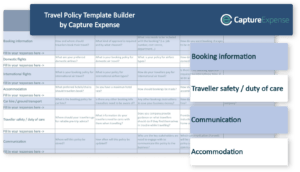

Travel Expense Policy Builder

From flights and accommodation to duty of care and communication—this policy builder template will help you outline all the key areas you need to include in your travel expense policy!