Automate Your Expense Policies and Save on Spend

Automatically enforce your expense policies at the point of claim with customisable spending limits, multi-stage approval workflows, and out-of-policy alerts that stop your teams from overspending.

Intelligent brands taking total control of company spend

Reduce your spend up to 44%

Reduce expense fraud

Only pay and claim on legitimate expenses within policy and reduce the risk of fraudulent claims, thanks to a suite of automated features to keep your spenders honest.

Save on costs

Save your business money by setting individual spending limits, out-of-policy warnings, and controlling approval stages so that your teams never overspend.

Improve spend habits

Automatically notify your teams when they submit an out-of-policy expense and host your expense policies in-app, so they always have access to the right information.

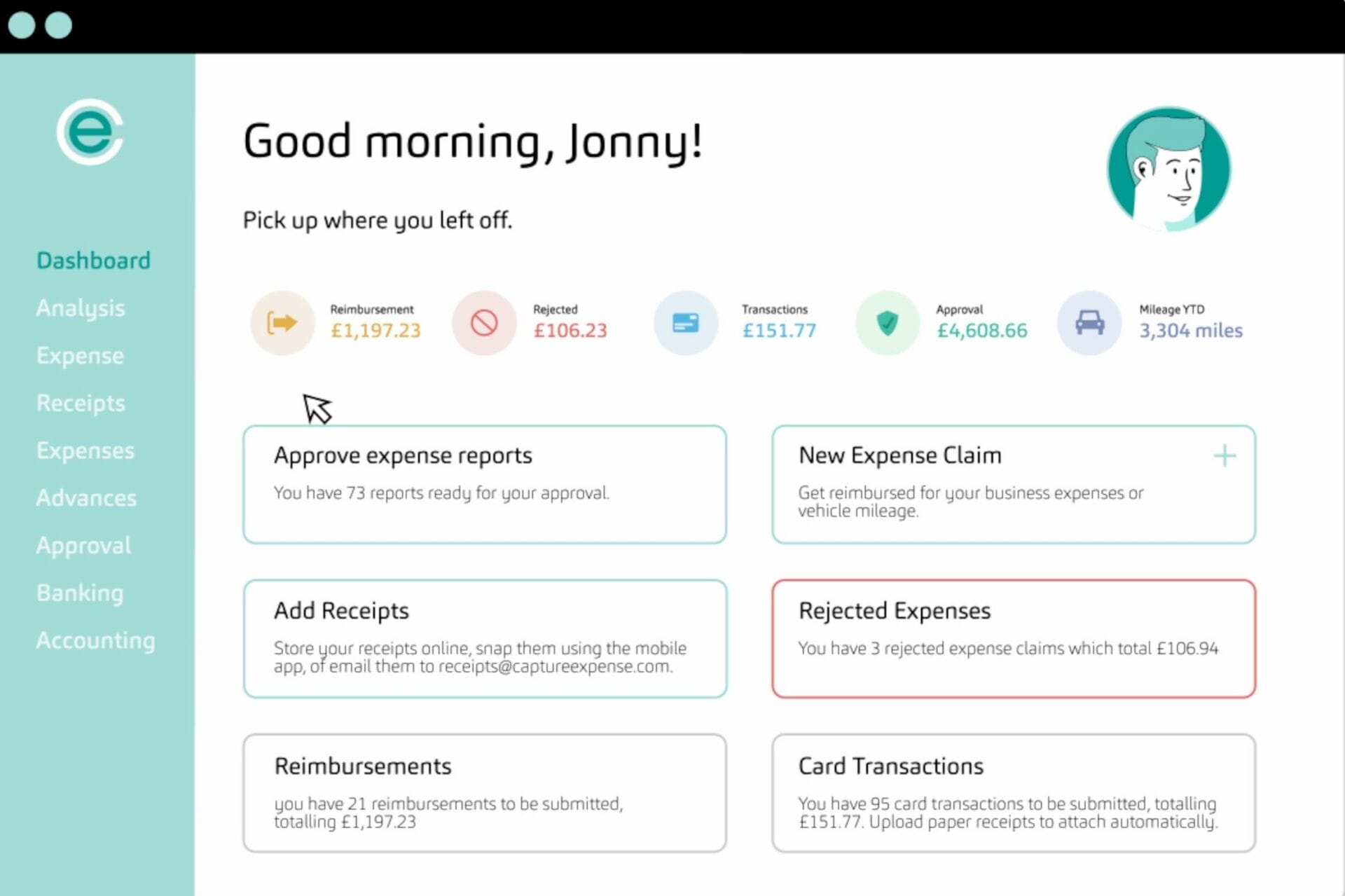

Find out more about Capture Expense

We’re so much more than just an app to track your business expenses. From saving days reconciling your credit cards to getting customised insights in an instant with your finance copilot, here’s everything you need to know about Capture Expense.

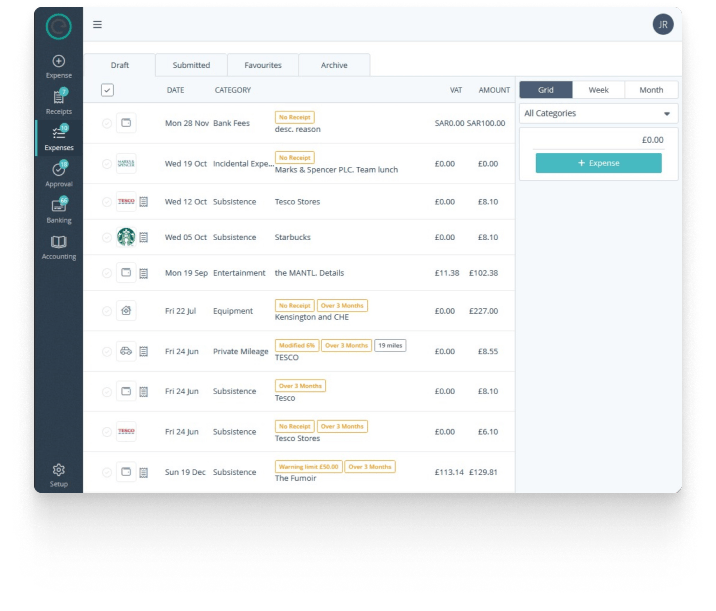

Enforce expense policies at the point of claim

Apply your own expense policies directly in the app, reinforcing the rules to your teams at the very point of claim. Paired with visual alerts, you’ll proactively stop your team from overspending and get everyone on the same page about their spend.

Set individual spending limits

Expense policies can be complex, with different spend types and limits applying to different roles, different departments, and different expense types. Your expense policies are fully configurable in Capture Expense, so everyone will follow the rules that apply specifically to them and their unique responsibilities.

The support we have received has been fantastic; we always receive a prompt and professional response with answers to any queries we may have. It is apparent how important it is to the team to continually improve Capture Expense and any feedback provided by us has been taken on board and almost always implemented for the best possible service.

– Business Systems & Procedures Supervisor

Create multi-stage approval workflows

Easily control the level of approval stages and customise the process for different types of expense claims—including conditional stages like claim amount and receipt date—to make sure no out-of-policy expenses slip through to your reimbursements.

Why choose Capture Expense?

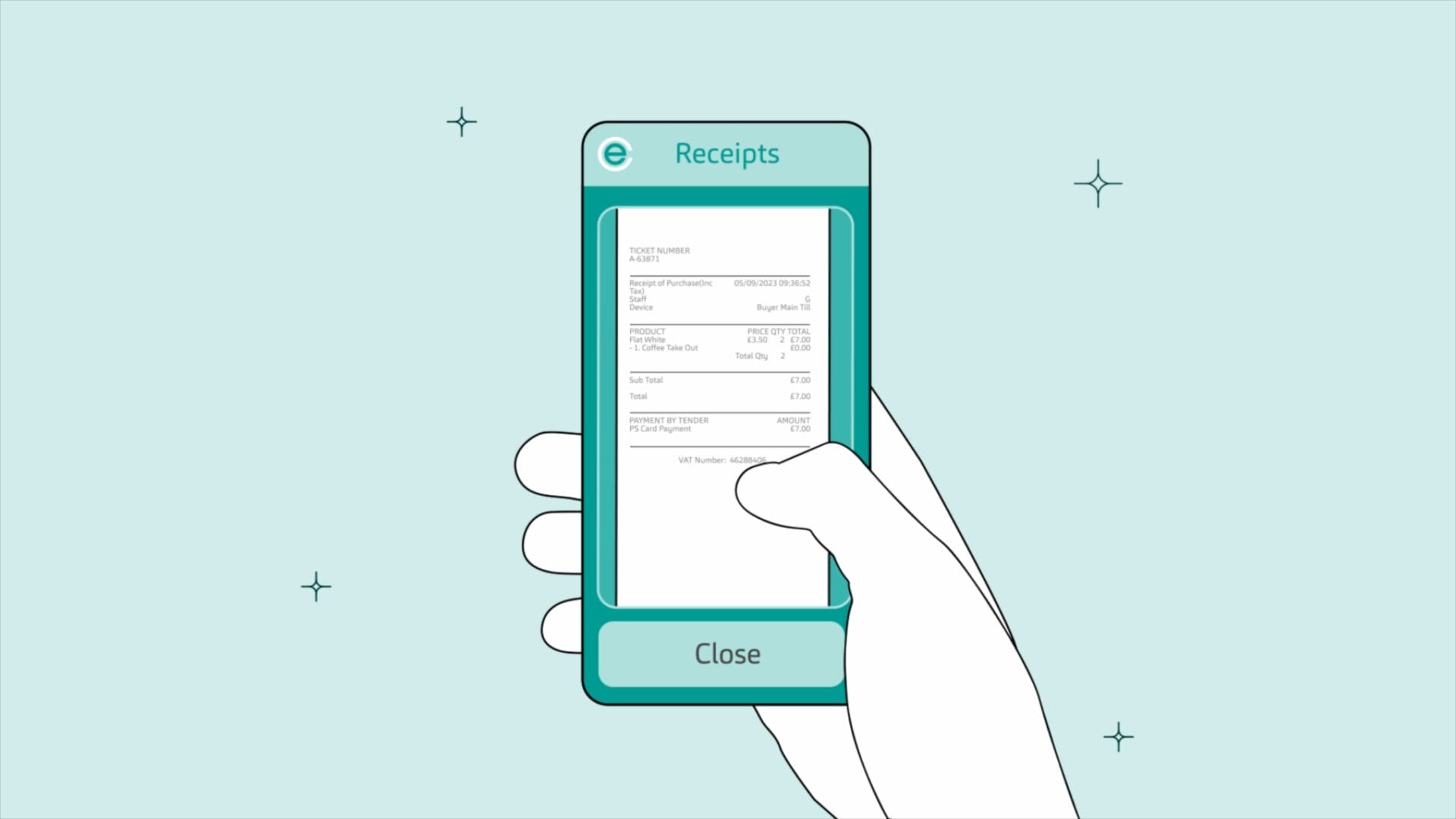

Total expense accuracy

Whether it’s pre-populated receipt data or automated mileage calculations, you’ll significantly improve the accuracy of your spend data.

All-in-one spend

By centralising your reimbursements, bills, and credit card transactions, you not only avoid the hassle of lost receipts but also significantly minimise paper-based tasks.

24/7 on mobile and desktop

Capture Expense is available on any device, at any time from any location. Its responsive layout means it adapts to every size of screen whether desktop, laptop or tablet.

Extra features alongside your expense policy controls

Expense Reporting

Effortlessly track and report on all spend—giving you a detailed breakdown by mileage, user, total expenditure, and more.

Corporate Card Reconciliation

Keep all your business expenses in one place with Open Banking integrations, for a real-time window into all company spend.

Global Expense Management

Simplify your expenses worldwide, no matter where and when your teams are spending around the globe.