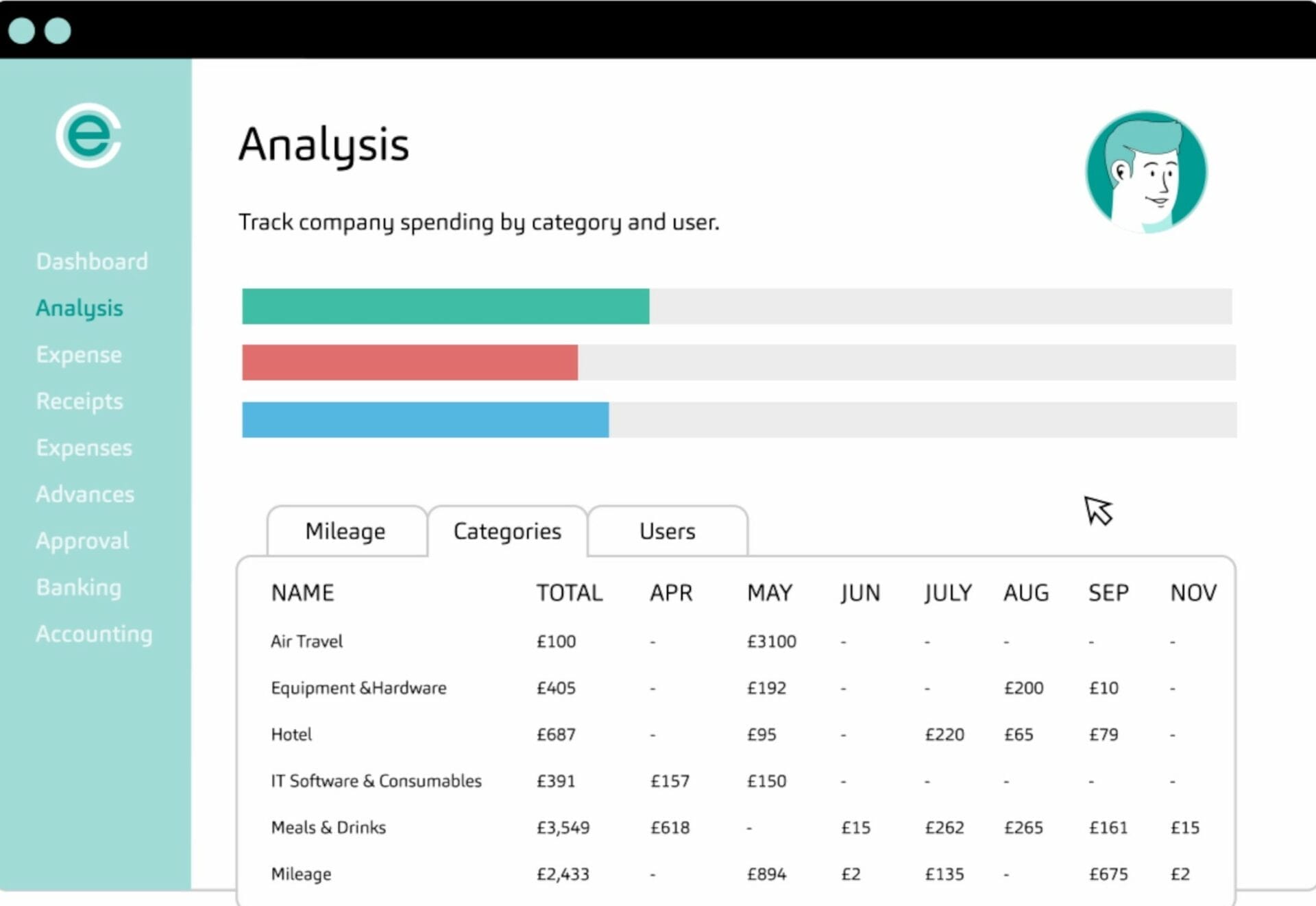

Automated Expense Reporting, Better Financial Decisions

Effortlessly track and report on all spend with Capture’s business expense tracker—giving you an instant detailed breakdown of spending by mileage, user, total expenditure, and more.

Intelligent brands taking total control of company spend

The business expense tracker with total spend transparency

Gain instant access to real-time spend reporting throughout your entire organisation, capturing expenses, bills, and credit card transactions as they happen. Your automated expense reporting means you’ll have every insight you need, whenever you need it.

Real-time insights

Access real-time spending data when tracking business expenses, automatically syncing data into your reports as and when spend happens.

Measurable results

Effortlessly identify overspend, conduct aged analysis, and gain a crystal-clear perspective on your expenses, allowing you to forecast future spending.

Single view of spend

Enjoy a comprehensive data overview where you can spot trends, monitor expenses, and maintain a firm grip on budget and cashflow.

Find out more about Capture Expense

We’re so much more than just an app to track your business expenses. From saving days reconciling your credit cards to getting customised insights in an instant with your finance copilot, here’s everything you need to know about Capture Expense.

Pre-built and custom company expense tracking

With a suite of pre-built expense reports in-platform, plus the ability to build any additional reports you need, you’ll always get the most from your company spend data in Capture Expense. Never miss an insight about your company’s financial health.

Get full spend visibility in one central platform

Link your company credit cards with Capture Expense and gain the ultimate view of all spend across your business, so you’re never missing a single detail. You’ll create a full audit-trail and summary of every transaction, helping you with procedures like VAT returns and end of year reports.

The implementation of Capture Expense’s streamlined approval process has been a game-changer for us. It’s made our previously complex workflow incredibly smooth and efficient. The platform’s capabilities have saved us time and effort, allowing us to focus on what truly matters.

– Project Leader

Track expenses in granular detail

Our expense reporting software gives you the ultimate flexibility in how and when you report on your business’s expenses. Use as many dimensions as you like to build reports against values such as role, team, department, office, cost centre, project, and more. In whichever way you choose.

Expense reporting FAQ’s

What are the benefits of using expense reporting software?

Simply put, using a business expense tracker like Capture Expense will save you time, reduce errors, and give you real-time visibility into spending patterns, so you can make better financial decisions for your entire organisation. It’s essential for maintaining financial health, budgeting effectively, and ensuring compliance with tax regulations.

How can automated expense reporting help me reduce expense fraud?

Here’s a few ways our business expense tracker can help you massively reduce the risk of expense fraud:

- Enforcement of policies: You can configure Capture Expense in line with your businesses expense policies. That way, your teams will be notified when their claims are out of policy, and you’ll be notified about any out-of-policy claims that come through.

- Receipt scanning: We use OCR technology to extract data from your teams’ submitted receipts, so you know that claim amounts match the actual spend.

- Audit trails: Capture Expense provides you with a detailed audit trail of expenses, including who submitted the expense, when it was submitted, and any modifications made. Total transparency deters fraudulent behaviour!

- Open banking: Integration with corporate cards will automatically reconcile credit card transactions with your expense reports, so everything is accounted for and flagged with any issues.

How long should I keep expense records?

Depending on your location and industry, there’ll be specific legislation you’ll have to stick to. For example:

In the UK, HMRC recommends keeping expense records for at least five years from the 31st January submission deadline of the relevant tax year.

In the US, IRS recommends keeping any tax-related records for three to seven years.

You might also face industry-specific requirements, such as healthcare and finance which have longer retention periods.

What's in an expense report?

An expense report typically includes:

- Date and description of each expense.

- Amount spent.

- Category or purpose of the expense.

- Method of payment.

- Receipts or supporting documentation.

Are reports in Capture Expense customisable?

Our company expense tracking is built around values such as role, team, department, location, cost centre, and so on. These dimensions can be used for complex analysis of your data. A two-dimensional analysis, for example, would be expenses by category and department—and you can use more than two dimensions for a more detailed analysis. The structure of the dimensions can be determined in combination with your chart of accounts, so when you integrated Capture Expense with your finance system, you’ll aid the correct allocation of the general ledger code to each transaction. So yes, reports in Capture Expense are customisable depending on what insights you’re looking for, and can be built in-line with your finance systems for a complete and accurate data sync.

Extra features alongside your business expense tracker

Reimbursements

Easily approve and manage reimbursements in Capture Expense, syncing data with finance and payroll for total ease.

Corporate Card Reconciliation

Keep all your business expenses in one place with Open Banking integrations, for a real-time window into all company spend.

Vehicle Mileage

Never miscalculate mileage again with Capture Expense’s smart automation, for accurate tax reclaims every time.