The Revenue Compliant Platform for Expenses, Travel, & Subsistence

Get all the features and functionality you need to keep your employee expenses compliant, in one central platform—packed with features built especially for businesses in Ireland complying with Revenue rules.

Intelligent brands taking total control of company spend

Travel and expense functionality that keeps you Revenue compliant

Approved fuel rates

Benefit from Revenue approved and advisory fuel rates for both corporate and personal vehicles included in the app as standard, so you’re always fully compliant.

Full reporting functionality

Effortlessly track and report on all spend in Capture Expense, including all the reports you need to fulfil Revenue obligations—like Enhanced Reporting Requirements.

Fully integrated

Full integrations with a suite of back-office systems—like Exchequer, Xero, Cintra, or Sage—gives you a seamless data sync that eliminates manual, repetitive admin work.

Find out more about Capture Expense for Ireland

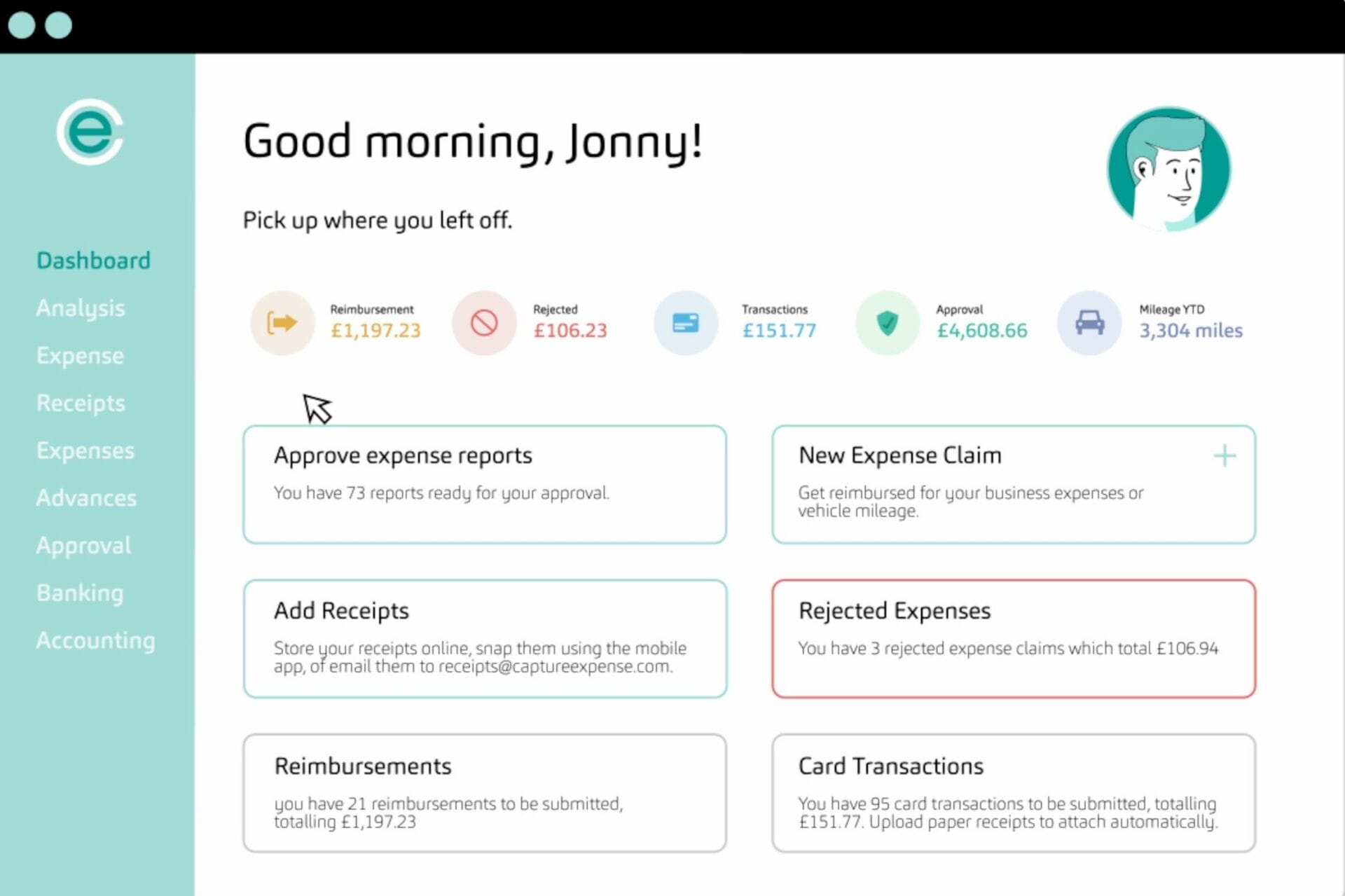

We’re so much more than just an app to track your business expenses. From saving days reconciling your credit cards to getting customised insights in an instant with your finance copilot, here’s everything you need to know about Capture Expense.

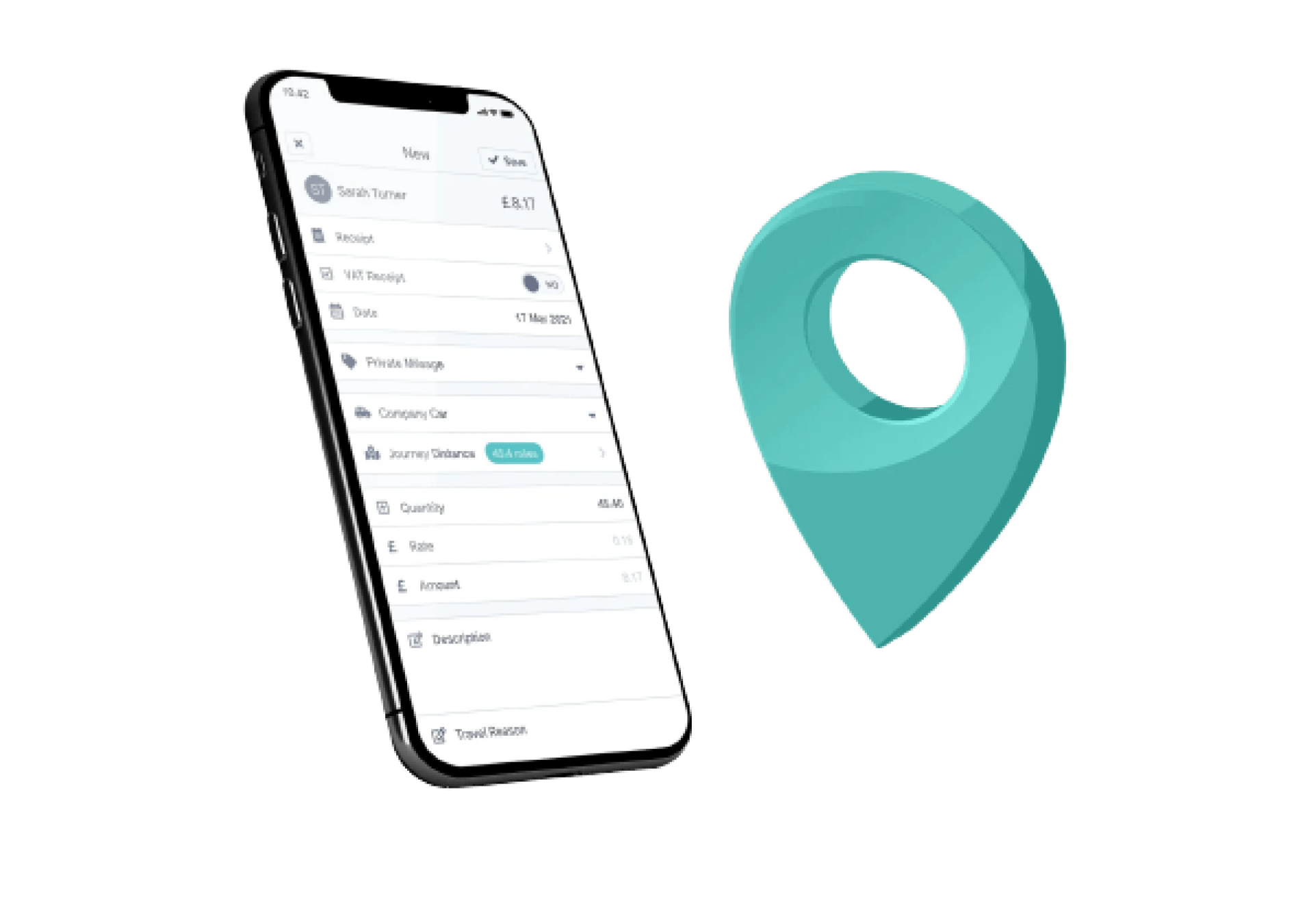

Built to manage cumulative bandings in vehicle travel and expenses

Capture Expense fully manages your cumulative mileage bands, automatically calculating your rate per kilometre changes depending on fuel, engine size, and distance travelled in the given tax year—so you’ll always reimburse the right amount in line with Revenue’s civil service rates.

You’ll also automatically calculate distance based on the lower of either the employee’s home or their normal place of work, so you’re fully covered with Revenue’s guidelines.

Full access to the reports you need for Enhanced Reporting Requirements (ERR)

Pull all of information you need to fulfil your Enhanced Reporting Requirements (ERR) directly in Capture Expense, giving you everything you need to stay Revenue compliant. In-platform, simply generate your report with data spanning:

- Small benefit exceptions

- Travel and subsistence

- Remote working daily allowance

The support we have received has been fantastic; we always receive a prompt and professional response with answers to any queries we may have. It is apparent how important it is to the team to continually improve Capture Expense and any feedback provided by us has been taken on board and almost always implemented for the best possible service.

– Business Systems & Procedures Supervisor

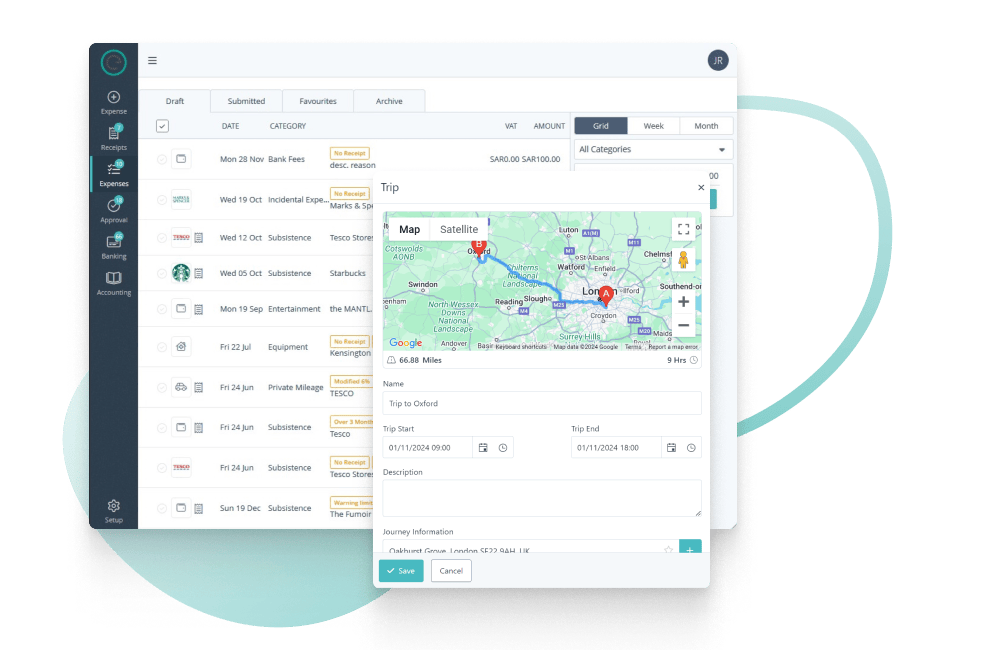

Set time-based limits for total compliance

In Capture Expense, you’re not limited to daily budgets across journeys and rates. Rates are based on the total duration of the work-related journey—like less than 5 hours, between 5 to 10 hours, or more than 10 hours.

You’ll find all of this in the functionality that we call Trips—which is your ultimate Ireland compliance partner for travel expense management. Our Trips functionality allows you full control over your subsistence rates, categories, journey hours, and reporting in a way that’s totally compliant with Revenue, so you have all the tools you need.

Why choose Capture Expense

75

44

60

34

Extra features alongside your business expense app

Reimbursements

Easily approve and manage reimbursements for out-of-pocket expenses in Capture Expense, syncing data with your finance and payroll systems for total ease.

Receipt scanning

Make the most of smart OCR and never manually process receipt data again. Enable your teams to snap and send receipts on-the-go, automatically creating and raising expenses.

Corporate Card Reconciliation

Connect your teams corporate credit cards to Capture Expense. Keep all your business expenses in one place with Open Banking integrations, for a real-time window into all company spend.

Global Capabilities

Customise spend in 100+ currencies and simplify your global transactions—no matter where your team travel.

Policy and Spend Control

Automatically enforce your expense policies at the point of claim and save on spend with customisable spending limits, multi-stage approval workflows, and out-of-policy alerts that stop your teams from overspending.

Why choose Capture Expense?

Total expense accuracy

Whether it’s pre-populated receipt data or automated mileage calculations, you’ll significantly improve the accuracy of your spend data.

All-in-one spend

By centralising your reimbursements, bills, and credit card transactions, you not only avoid the hassle of lost receipts but also significantly minimise paper-based tasks.

24/7 on mobile and desktop

Capture Expense is available on any device, at any time from any location. Its responsive layout means it adapts to every size of screen whether desktop, laptop or tablet.

A Guide to Expense Management Compliance in Ireland

The information you need to make sure your business complies with Revenue guidelines across policies, tax, reporting, allowances, and more—bridging the gap between in-depth explainers and those that lack the extra context you need!