The Best Way to Manage Your Reimbursements

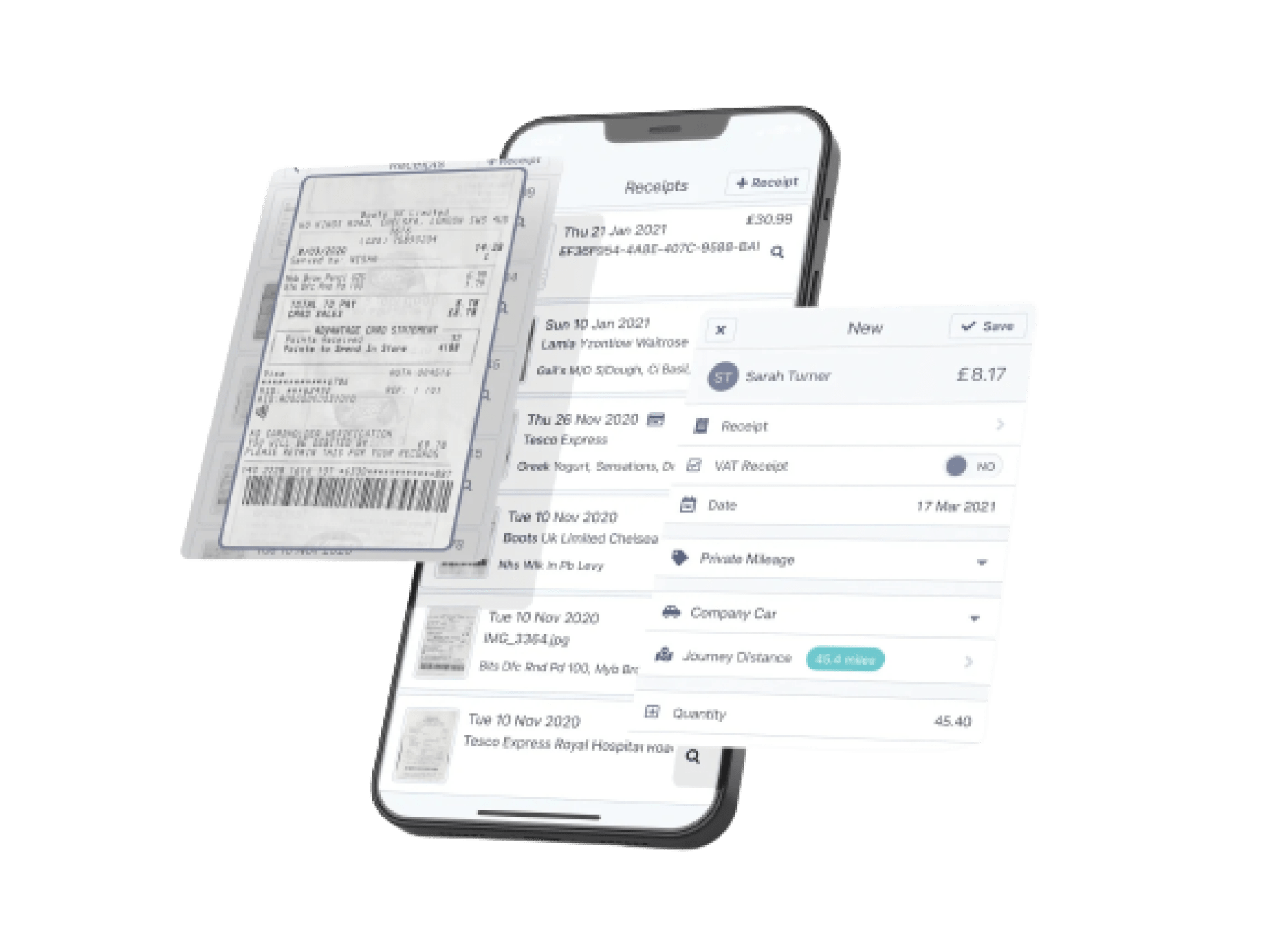

Simplify and automate how you manage your expense reimbursements using the intuitive Capture Expense app.

Intelligent brands taking total control of company spend

Reimbursed expenses that reduce admin and save on spend

Creating, submitting, and reimbursing expenses has never been so easy:

1

Snap the receipt

Our OCR uses AI to process and extract the data from your receipts so you don’t have to type a thing.

2

Submit the expense

The data from the receipt is used to automatically generate expenses.

3

Approve on the go

Approve your teams’ submitted expenses on-the-go or at-your-desk, with full functionality on both mobile and desktop.

Find out more about Capture Expense

We’re so much more than just an app to track your business expenses. From saving days reconciling your credit cards to getting customised insights in an instant with your finance copilot, here’s everything you need to know about Capture Expense.

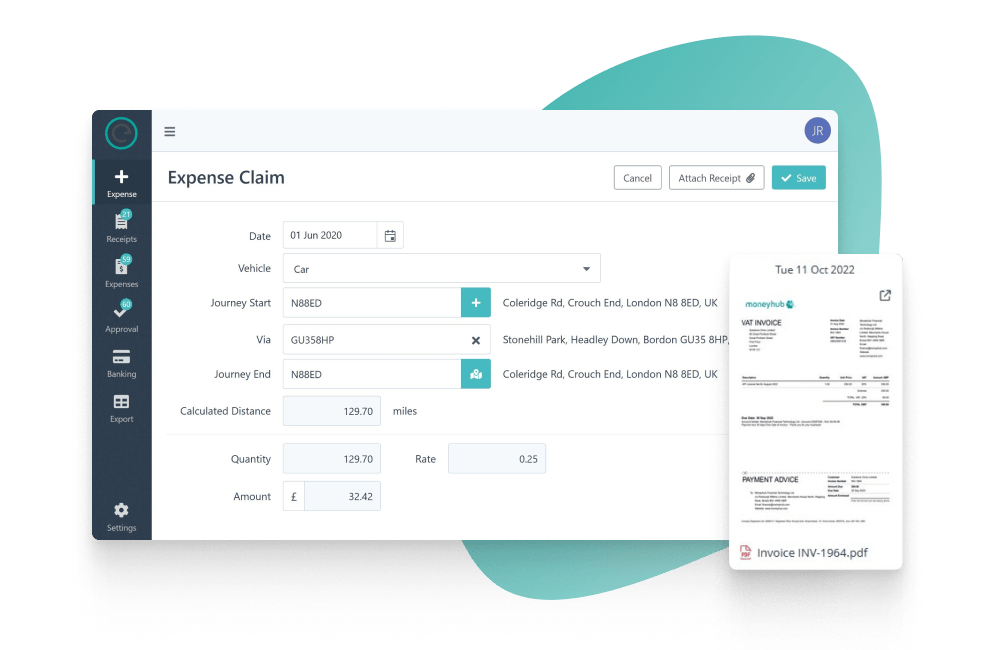

The most efficient way to manage your reimbursements

We integrate with all your finance and payroll systems for a seamless data sync, making it simple to manage your reimbursed expenses:

Through payroll

By syncing Capture Expense with your finance and payroll software, you can easily reimburse employee expenses alongside their usual salary.

Direct to bank

Don’t want to wait until payday to sort your outstanding expenses? Easily generate a bank file that will pay your expense reimbursements via BACS.

Save on costs with reimbursements over prepaid cards

Wondering whether you should give your teams prepaid cards, or take the reimbursement route? What organisations often swap for the convenience of prepaid cards, is higher costs.

But with reimbursements, there’s better limits on how people spend when being reimbursed, reducing the risk of overspending or spending out of policy—since there’s no need to return anything spent out of policy.

Track and report on reimbursements

Easily review your monthly reimbursements and make the most of advanced filtering functionality to dive further into the details. All expense reimbursements are automatically shown in your reports and synced with your finance software—so you barely have to lift a finger.

The software is very adaptable and the mileage claims/tracker functionality works very well with our growing fleet. It was also very easy to implement with great support from the Capture Expense team.

– Commercial Finance Manager

Automated expense reimbursement around the globe

Capture Expense is purpose built for global spending, so you can reimburse expenses no matter where your employees are. You’ll reimburse your teams in their local currency no matter what currency they’ve spent in—automating the process from point of receipt capture with real-time exchange rates.

Reimbursements FAQ’s

What is expense reimbursement?

Expense reimbursement is when employers pay back their employees for work-related expenses out of their own pocket. Proper documentation, such as receipts or invoices, is usually required to support reimbursement claims and ensure compliance with company policies and tax regulations.

How are expenses submitted in Capture Expense?

Your teams take a photo of their receipt from the Capture Expense app, which will automatically generate the expense by prepopulating the claim using data from the receipt. Once they submit this and have received approval on their spend, the expense will be ready to reimburse.

What types of expenses are typically reimbursed?

Typical reimbursed expenses include:

- Travel expenses: Such as airfare, lodging, rental cars, and mileage.

- Meals and entertainment: Costs incurred during business meetings, client lunches, or team outings.

- Transportation: Including public transit fares, taxi rides, or parking fees.

- Office supplies: Necessary items purchased for work-related tasks.

- Professional development: Fees for conferences, workshops, or training courses.

- Communication expenses: Such as cell phone bills or internet expenses if used for work purposes.

- Miscellaneous expenses: Other business-related costs, like shipping fees or business-related subscriptions.

Specific reimbursable expenses may vary depending on company policies and the nature of the employee’s job.

Are reimbursed expenses taxable?

Reimbursed expenses are typically not considered taxable income for employees if they are for legitimate business purposes and are reimbursed according to the company’s accountable plan. An accountable plan is one that requires employees to provide documentation for their expenses and return any excess reimbursements. As long as the reimbursement process meets the criteria of an accountable plan, the reimbursements are not subject to income tax or payroll taxes.

Why is a reimbursement approach better than pre-paid cards?

A reimbursement approach helps you save on costs as there are better limits on how people spend when being reimbursed, reducing the risk of overspending or spending outside of policy associated with pre-paid cards. Enforcing expense policies is more straightforward with reimbursement since there is no need to return anything spent out of policy, simplifying compliance and adherence to company guidelines.

Extra features alongside your reimbursed expenses

Receipt Scanning

Enable your teams to snap and send receipts on-the-go, automatically creating and raising expenses.

Corporate Card Reconciliation

Keep all your business expenses in one place with Open Banking integrations, for a real-time window into all company spend.

Vehicle Mileage

Never miscalculate mileage again with Capture Expense’s smart automation, for accurate tax reclaims every time.