CASE STUDY

From 1.5 days to 1.5 hours processing monthly business expenses

HTS’ digital journey with Capture Expense

2494 expenses processed

through Capture Expense in one year.

1561 receipts uploaded

in one year through the sophisticated Capture Expense platform.

Capture Expense has transformed HTS’ expense management process, delivering time savings, increased accuracy, and enhanced oversight

HTS Group Ltd, serving the community in Harlow as the local authority trading company, was struggling with an outdated, manual expense management system.

With 20 employees relying on inefficient processes for reimbursements and credit card reconciliations, errors piled up, and the finance team was losing up to two days every month just trying to keep things on track – meaning month-end closures were constantly delayed.

That’s when HTS turned to Capture Expense. By automating their expense management, they transformed a messy, time-consuming task into a smooth, efficient process. With fewer errors and more time on their hands, the finance team could finally focus on what really mattered.

“We loved the personal touch from the Capture Expense team. They tailored their system to meet our business needs, which was fantastic.

I worked closely with Susie, Jonny, and James to address initial issues with data imports from Sage 50 and James helped correct everything from a finance perspective.

Everything runs smoothly and we couldn’t be happier with the platform!”

– Amy Edwards , Group Management Accountant

The challenge

- Manual processes: expense reimbursements and credit card reconciliations were entirely manual, leading to inefficiencies and errors.

- Time-consuming tasks: expense processing and bank reconciliations took one and a half to two days per month, delaying month-end closures.

- Human errors: manual entries led to a higher likelihood of mistakes, including issues with VAT reclaims due to missing receipts.

- Integration difficulties: HTS needed an expense management solution that could integrate seamlessly with their existing payroll system Cintra Payroll and Sage 50.

- Inefficient authorisation process: manual approvals on physical sheets led to lax oversight, with few expense claims being rejected or scrutinised.

The solution

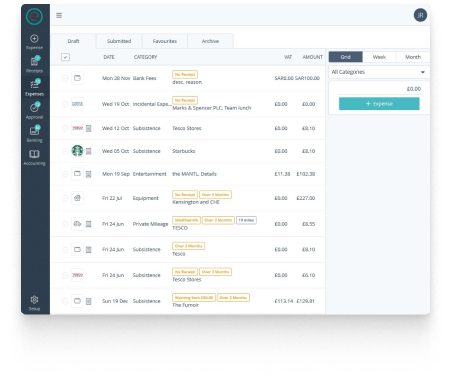

- Automated processes: Capture Expense has completely streamlined HTS’s expense reimbursements and credit card reconciliations, eliminating the need for manual data entry.

- Integration capabilities: the system integrated effortlessly with Cintra payroll and their bank provider Barclays, as well as Sage 50 for imports, making the reconciliation process much smoother.

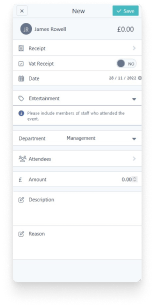

- Scan and save receipts in seconds: HTS’ active users can scan and store their receipts from their smartphone, from any location, in real time. This guarantees that all receipts are secure and readily accessible.

- Easy-to-use approval system: Capture Expense offers HTS a streamlined and intuitive approval process, facilitating thorough claim reviews and ensuring accurate and timely reimbursements.

The benefits

- Improved accuracy: HTS will experience fewer errors, particularly in VAT reclaims, thanks to the system’s checks and mandatory receipt submissions.

- Enhanced oversight: with the requirement for receipt reviews, HTS can maintain vigilant expense claims and achieve better cost control.

- Flexibility: HTS can enjoy the convenience of using both the Capture Expense app and desktop interface, catering to the preferences of their diverse users.

- Automated reminders: Capture Expense will prompt HTS’ active users to correct any errors or attach missing documents, alleviating the finance team from chasing down receipts.

- Money saved: the approval process ensures that HTS doesn’t reimburse incorrect or irrelevant claims, leading to reduced spending for the company.

The results

30 hours saved per month

Automating the process saved significant time, allowing the finance team to focus on more strategic tasks.

Increased accountability

The new system ensures that all expenses are thoroughly reviewed, reducing improper claims and improving cost management.

Automated checks for flagging duplicate receipts and other errors have been implemented to enhance accuracy in claims processing. This functionality helps to identify and eliminate potential mistakes, ensuring a smoother workflow.

Capture Expense Brochure

Dive into our brochure to discover how you can stay on top of reimbursements, bills, and credit card transactions as they happen—while reaping the benefits of real-time spending insights across your entire organisation.