From Excel to Excellence:

Capture Expense’s Impact on DoNESC’s Paperless Journey

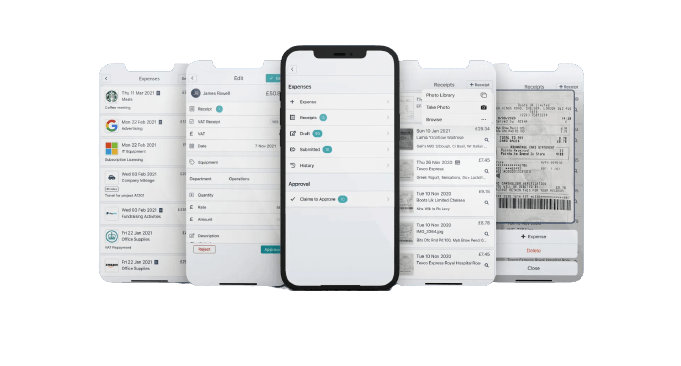

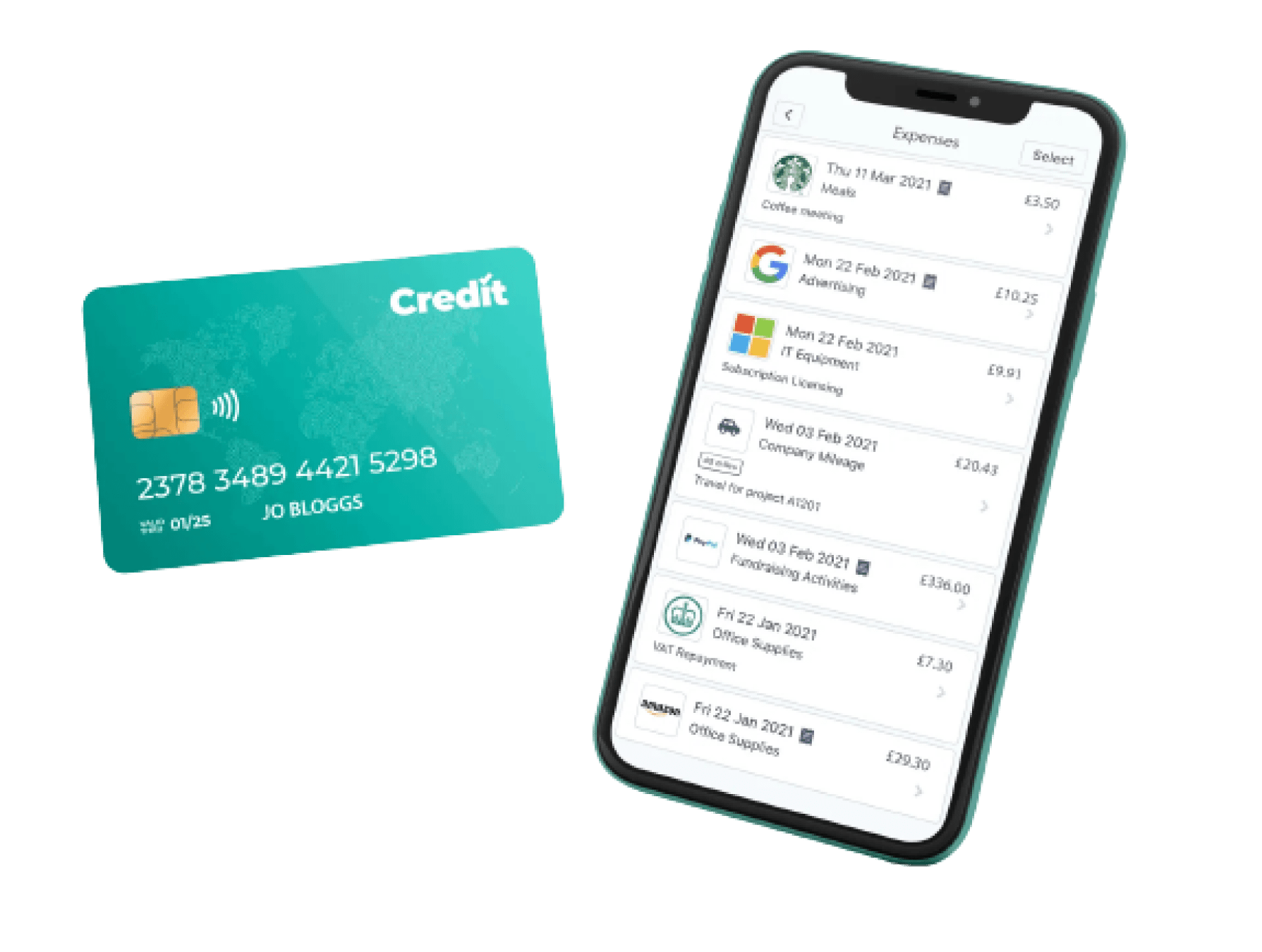

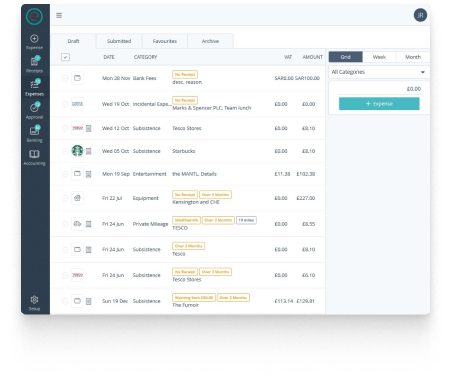

A user-friendly system

supporting over 340 users across multiple organisations, managed by a small finance team.

A paperless transformation

replacing a manual Excel-based system with an automated digitised one.

Capture Expense effortlessly manages 80+ monthly expense claims, streamlining DoNESC’s financial reporting process

The Diocese of Norwich Education Services Company (DoNESC) is a not-for-profit organisation dedicated to delivering high-quality, cost-effective services to academies within the Diocese and beyond. Their mission extends to managing 41 academy sites under the Diocese of Norwich Education and Academies Trust (DNEAT) umbrella and an additional 14 under St Benet’s.

Furthermore, the platform oversees two multi-academy trust staff and operates the services of the DoNESC services company, encompassing approximately 17,000 pupils and representing over 25% of primary pupils in Norfolk.

With 80% of our claims being travel-related, manual tracking was a time-consuming task, but Capture Expense streamlined the process, ensuring accurate and efficient recording of travel expenses.

– Financial Controller

The challenge

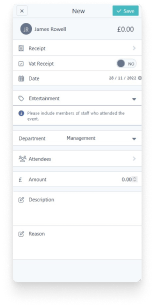

- Manual tracking: 80% of claims are travel related, a considerable amount of time is taken having to check that the claimant has recorded the correct information. Mileage claims were particularly difficult to audit, with no controls for deducting the commute element.

- Data synchronisation: unable to seamlessly integrate with their Xero and PSF accounts, hindering their efficiency in financial management.

- Lack of intuitive design: The current system makes it challenging for users to seamlessly move through processes, leading to frustration and potential errors.

The solution

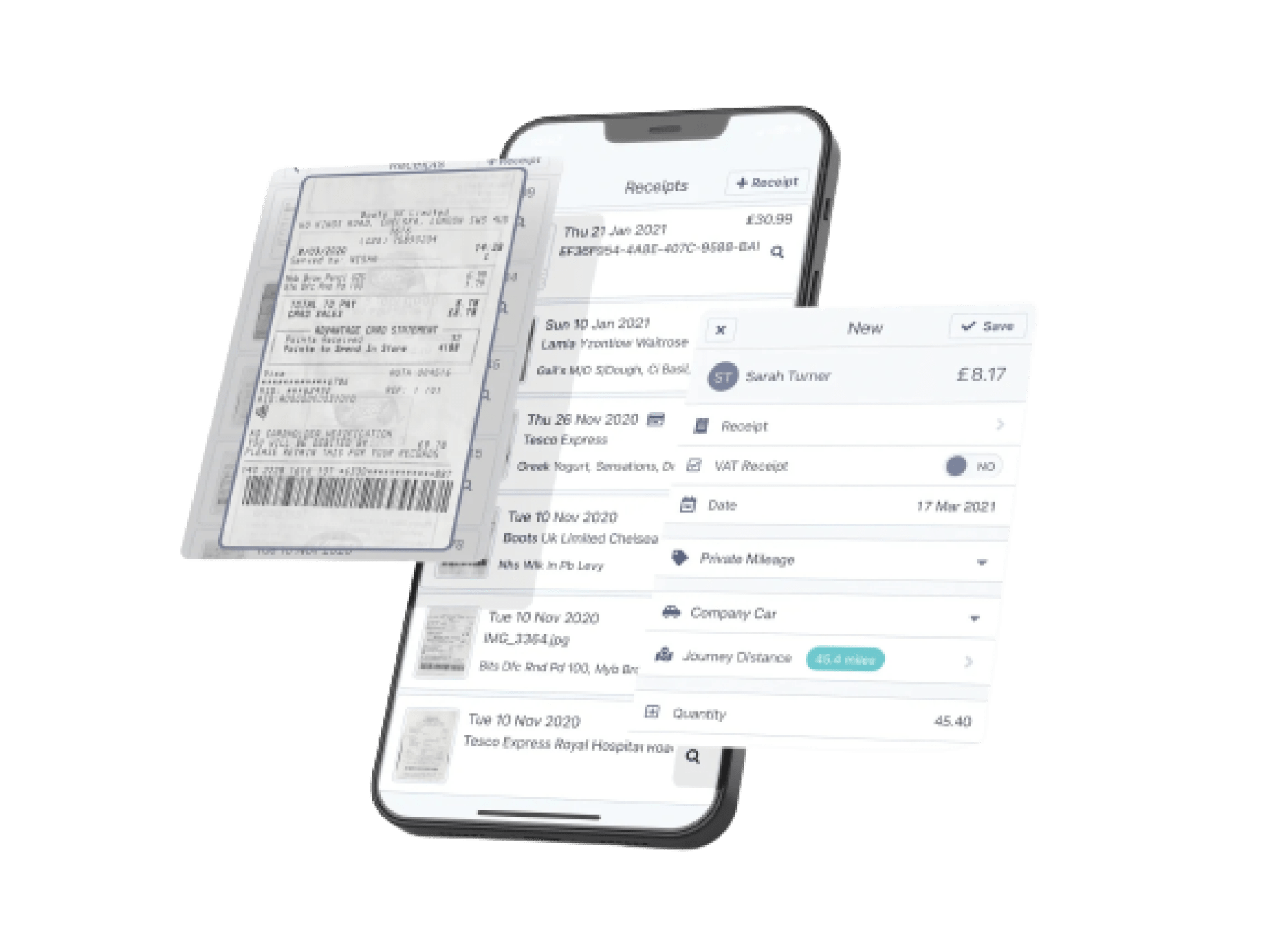

- Precise mileage tracking: Capture Expense streamlines the process by automatically verifying and storing accurate travel-related information for claimants, reducing the time and effort required for manual checks

- Seamless integration: Capture Expense’s RESTful API service provides seamless integration with Xero. It also facilitates effortless integration with PS Financials through a formatted export file.

- Fast implementation: Capture Expense is designed for minimal training, ease of setup and maintenance, we also provide a dedicated consultant during implementation.

The benefits

- Capture Expense automatically calculates mileage journeys through a seamlessly integrated Google service.

- Apply company polices and rules automatically to reduce out of policy claims.

- Automatic card reconciliation and bank feed with Open Banking.

- Modern software design for ease of use and minimal training.

The results

Fully digitised system

Transforming DoNESC’s expense processes into a fully digitised system has led to quicker processing, accurate data management, and improved overall cost-effectiveness.

Accessible anywhere, anytime

The ability to access the system on both mobile and desktop ensures unparalleled flexibility, enhances their responsiveness, and overall ease of use.

Enhanced efficiency

By replacing Excel Workbook expense forms with dynamically generated online forms DoNESC can now streamline their expense submission process, keep track of their expenses and make well-informed business decisions.