Managing expenses across multiple countries is complicated. Most systems aren’t built to handle the differences between regions, relying on rigid rules that need constant updates and failing to properly support multiple languages.

AI is changing that. At Capture Expense, we’ve explored how generative AI can take on some of the biggest challenges in global expense management; and we’ve built features that remove unnecessary steps and make it easier for teams to submit expenses. But AI still has its limits—especially when it comes to compliance, and even more so for compliance across multiple countries.

So, we’re going to look at what all that means, and explain in the simplest terms where AI can and can’t help your global expense management.

Why businesses struggle managing expense compliance and localisation

There’s no doubt that managing expenses across multiple countries is hard work; global businesses have to face different tax rules, per diem rates, and reimbursement policies (to name a few) across countries. And without the right systems in place, it’s extremely difficult to keep up—risking errors, delays, and non-compliance. Here’s why expense management systems typically struggle:

Hard-coded rules

Expense management systems typically rely on hard-coded rules, meaning they have to be manually updated every time regulations change. This is inflexible and difficult to maintain, which is why a lot of SaaS providers struggle to support multiregional teams in such heavily-regulated areas of a business.

Language translations

Then there’s language barriers, which usually rely on basic translations that happen directly in the systems interface. This means they might struggle to truly adapt to different languages, leaving employees struggling to properly understand the expenses process.

How AI solves the multi-language problem

As we mentioned, many systems rely on translations directly in the interface, which also means that users rely on the provider to make each individual language available. That can leave employees struggling to submit their expenses correctly if the app doesn’t support a language they’re fluent in—ultimately leading to more unnecessary barriers in the expenses process.

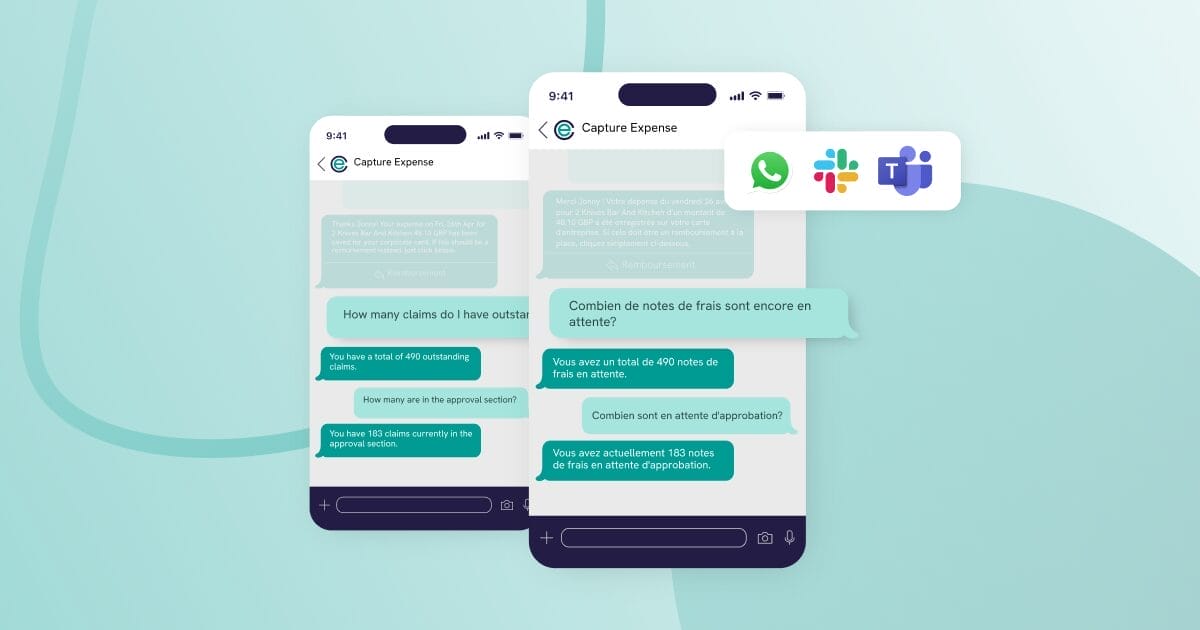

But when we use AI as the core method of raising expenses, things change. We’re building a process that allows your teams to raise expenses in the apps they already use every day, without having to go into an expenses system. Here’s how that works:

- Integrating with everyday messaging apps: We’re plugged into apps like WhatsApp, Teams, and Slack, so your teams can submit their receipts and raise expenses via a quick text and never have to open Capture Expense.

- Embedding conversational AI: The bridge between messaging apps and Capture Expense is conversational AI (like ChatGPT) so your users can use natural language to raise their expenses and access instant support for any of their questions.

- Automatic translations: No matter what language your users speak in to submit their expenses and ask questions, the AI will reply in that language. If an employee submits an expense in French, for example, the AI understands the input and responds in French.

- No manual programming: It adapts instantly to whoever is speaking to it, without having to build individual languages into the interface. They’re already there and ready to use, giving way more flexibility and accessibility.

- Natural interactions: Because of the nature of conversational AI, users can interact in normal text-messaging style. There’s no need for structured responses or form submissions—just speaking like they usually would in a message.

Get the latest insights and product updates, direct to your inbox.

AI’s limitations in global expense compliance

While AI excels at user interaction and real-time translations, there’s still a lot of complexity involved for global regulatory compliance. It may be able to interpret tax rules, categorise expenses, and flag potential compliance issues, but global tax laws are extremely complex and changing frequently, and so human judgement will still play a large role. Here’s how it can and can’t help:

Why AI can’t automate global expense compliance

Ultimately, the compliance rules (like VAT rates, per diem, reimbursement policies) would need to be manually set at the platform level for the AI to then recognise whether expenses are compliant.

That’s because AI isn’t inherently aware of regional tax laws and needs pre-defined guidelines to work effectively. Simply put, AI can only apply the rules—it can’t create them.

How AI can support global expense compliance

Once the correct rules are in place, AI can automate compliance moving forward (but ongoing human oversight will still be needed). It can interpret the policies in place (both global compliance legislation and your own company policies) so it can identify things like the correct VAT or GST rate depending on the location of the expense, or automatically assign an accounting category to expenses based on data automatically pulled from receipts.

While there’s still some manual setup at the start, AI makes it far easier to stay on top of compliance once those rules are in place. Finance teams can start to rely on AI to catch issues early, reduce errors, and speed up approvals—instead of checking every expense manually.

Overcoming international spend challenges with Capture Expense

AI can’t handle global compliance on its own, but it can certainly make things a lot easier.

At Capture Expense, we’re committed to implementing AI at every stage of the process it can help. We’re constantly releasing new features, with our latest AI functionality including:

- Everyday messaging apps: so your teams can submit expenses and access support through apps like Teams, Slack, and WhatsApp with a quick text.

- Finance Copilot: so you can pull every and any insight you need in seconds, by simply telling your copilot what you need to know.

- Category matching: so you can automatically apply categories and VAT to expenses without manual intervention.

- Currency conversions: so no matter where your teams are spending money, it’ll be automatically converted and reimbursed in their base currency.

- SmartAudit: so you can automate approval workflows by training AI to make real decisions based on your rules and policies.

We know there’s a better way to manage global expenses, so we’re committed to building it. Get in touch to find out more about what we’re doing, and how it can work for you.

Find out more about Capture Expense

We’re so much more than just an app to track your business expenses. From saving days reconciling your credit cards to getting customised insights in an inside with your finance copilot, here’s everything you need to know about Capture Expense.