There’s nothing quite like a business trip. Exploring new cities, meeting interesting people, and learning new things. It’s a great way to break up the monotony of the daily grind and add some excitement to your work life.

But let’s be honest. Nothing quite kills that refreshed, post-trip feeling like coming home to the task of filing a travel expense report. All those receipts, mileage logs, and itemised lists can feel tedious. Necessary? Absolutely. Exciting? Not so much. It’s the paperwork price you pay for all those moments of professional adventure.

What if we told you that you could manage all your travel and expenses (T&E) in a matter of minutes? What if we told you the whole process could be fully digitised and automated?

Now that we’ve got your attention. Let’s look at what T&E means, some key examples and how you can streamline your entire travel and expense management process.

What does T&E mean?

T&E refers to the costs incurred by employees or individuals when traveling for business purposes. These expenses typically include transportation, accommodation, meals, and other incidental costs necessary to carry out their work-related duties while away from their usual workplace.

T&E examples

There’s a lot that can fall under the umbrella of T&E. Let’s break it down:

Transportation

This includes the big things, like booking flights, train tickets, or renting a car to get to your destination. It also covers smaller, day-to-day transport expenses like taxi rides, parking fees, or public transport passes if you’re getting around in a city.

Accommodation

Your stay is a key part of the budget, whether it’s a hotel, serviced apartment, or Airbnb. Beyond the nightly rate, it might also include any Wi-Fi fees or charges for using business facilities, like meeting rooms—make sure you make it clear in your T&E policy whether this will be included, or comes at the employees own cost.

Meals

Everyone’s got to eat, right? This includes dining out at restaurants, grabbing a quick bite at a café, or ordering room service. Don’t forget about snacks and drinks during the day or those team dinners that turn into great networking opportunities. There’d usually be a set spend limit on how much an employee can claim depending on length of their trip and what meal of the day it is; so make sure this is totally clear before you go out for that gourmet, 3-course meal.

A real-world example

Imagine you’re a sales rep for a tech company. You’re scheduled to fly to San Francisco for a big three-day conference. You book your flight, reserve a hotel room, and rent a car to get around the city. While you’re there, you’ll need to cover the cost of meals and any additional transportation expenses.

All of these costs combined would be considered T&E expenses.

Get the latest insights and product updates, direct to your inbox.

6 T&E challenges and how to solve them

Manual processes

Processing your travel and expenses manually might seem manageable at first, but it quickly becomes a bottleneck as your business grows. Manual processes are time-consuming, prone to errors, and can lead to your finance teams spending excessive time reviewing claims.

The solution: you should consider automating your entire travel and expense process with a sophisticated expense management system like Capture Expense. It will help you streamline everything from receipt capture and expense submission to policy enforcement and approval workflows—saving time and providing greater control over your expenses.

Policy non-compliance

This is a major challenge in managing your travel and expenses because it can lead to overspending and inconsistent claims for your business. Sometimes your employees may not fully understand the policies, or they might accidentally—or even deliberately—submit claims that don’t align with company guidelines.

So, if you’re wondering whether you need a corporate travel policy. The answer is yes. A robust T&E expense policy is like a roadmap for your business trips. It sets clear guidelines on what expenses are reimbursable, how much you can spend, and what kind of documentation is required.

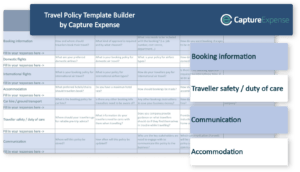

To help you get started, you can download our free corporate travel policy template.

Lost receipts

When it comes to T&E expenses, lost receipts are a huge headache for everyone involved. Your employees can’t claim reimbursements without proof of purchase, your finance teams can’t process the expense, and your managers end up chasing people for missing details.

So, why does this happen so often? Think about it—when you’re traveling, you’re juggling trains, meetings, meals, and taxis. Receipts get crumpled, misplaced, or accidentally tossed out. If you’re relying on manual systems, the problem only gets worse because there’s no backup unless someone took the time to snap a photo or make a note.

The solution? Whether you’re handling finances manually or digitally, it starts with making it easy to capture receipts right away. If you’re sticking to a manual process, encourage your employees to use their phones to take pictures of receipts the moment they get them. For a truly effective solution, though, modern expense management apps are the way to go. They let your employees snap, upload, and categorise receipts in seconds, even while they’re on the move. The data is automatically synced to your accounting system, so there’s no risk of losing it—and no more chasing people for missing paperwork.

Budget overspending

Overspending can spiral out of control fast. A little extra here for a last-minute hotel upgrade or an unplanned meal there might seem harmless, but multiply that across dozens of employees and trips, and you’ve got a major dent in your budget.

The problem usually comes down to a lack of visibility and control (but more on that later). If your employees don’t have clear spending limits or real-time guidance on what’s allowed, they might unintentionally exceed budgets. And if your finance teams only see expenses after the trip is over, it’s too late to fix the problem.

The way to deal with budget overspending is proactive planning and real-time oversight. Start by setting clear budgets and policies for travel expenses, so your employees know exactly what’s acceptable.

Consider bringing in a tool that helps enforce those guidelines in real time. Robust expense management platforms can flag out-of-policy spending instantly, give your employees budget updates on the go, and even alert your managers if someone’s about to exceed limits.

This way, you’re not just reacting to overspending—you’re preventing it before it happens.

Delayed reimbursements

Imagine spending your own money on a work trip—flights, meals, taxis—only to wait weeks or even months to get it back. It’s frustrating, especially if the expenses were significant.

For your finance teams, delayed reimbursements are a sign of inefficiency. Processing piles of expense reports, chasing missing receipts, and manually checking for policy compliance takes forever. The longer it takes, the harder it is to manage cash flow and keep your employees happy.

So, what’s the answer? It all comes down to speed and automation. An expense management system can simplify your entire process. Employees can submit expenses in real time—by snapping a photo of a receipt—and finance teams get all the data they need in one place.

Poor visibility into spending patterns

Think about trying to manage all your company’s finances with a pen and paper. It’d be a lot of work, and easy to make mistakes. That’s kind of what it’s like using manual spreadsheets or legacy software for your T&E expense reports.

These outdated methods can’t automatically check if your expenses are within policy limits or if you’ve got the right receipts. It’s all up to you to do the calculations and spot any errors. And let’s be honest, human error is inevitable.

You’re in luck because the solution here, is the same one as all the others: a modern, fully automated expense management system. Tools like Capture Expense can automatically categorise expenses, flag policy violations, and generate accurate reports in real time.

Are you looking for a platform that can streamline your entire T&E process?

With just a few taps, you can capture receipts, automate employee reimbursements, and manage everything else with ease. Book a demo today and see how we can help streamline your entire T&E process.

Travel Expense Policy Builder

From flights and accommodation to duty of care and communication—this policy builder template will help you outline all the key areas you need to include in your travel expense policy!