Why Manual Expense Tracking is Holding Your Business Back (And How to Fix It)

Spreadsheet expense tracking can be a significant hindrance to a business’s success.

As a business owner or finance manager, you know that tracking expenses is a necessary part of running a successful business. However, manually tracking expenses can be a time-consuming and error-prone process that can hold your business back in several ways.

Here are some reasons why manual expense tracking is holding your business back, and how to fix it with a modern expense management platform.

Manual Expense Tracking is Time-Consuming

Manually tracking expenses involves collecting receipts, entering data into spreadsheets, and cross-checking information to ensure accuracy. This process is not only time-consuming, but it can also be tedious and prone to errors. For businesses with a high volume of expenses, this can become an overwhelming task that diverts time and resources from other important business functions.

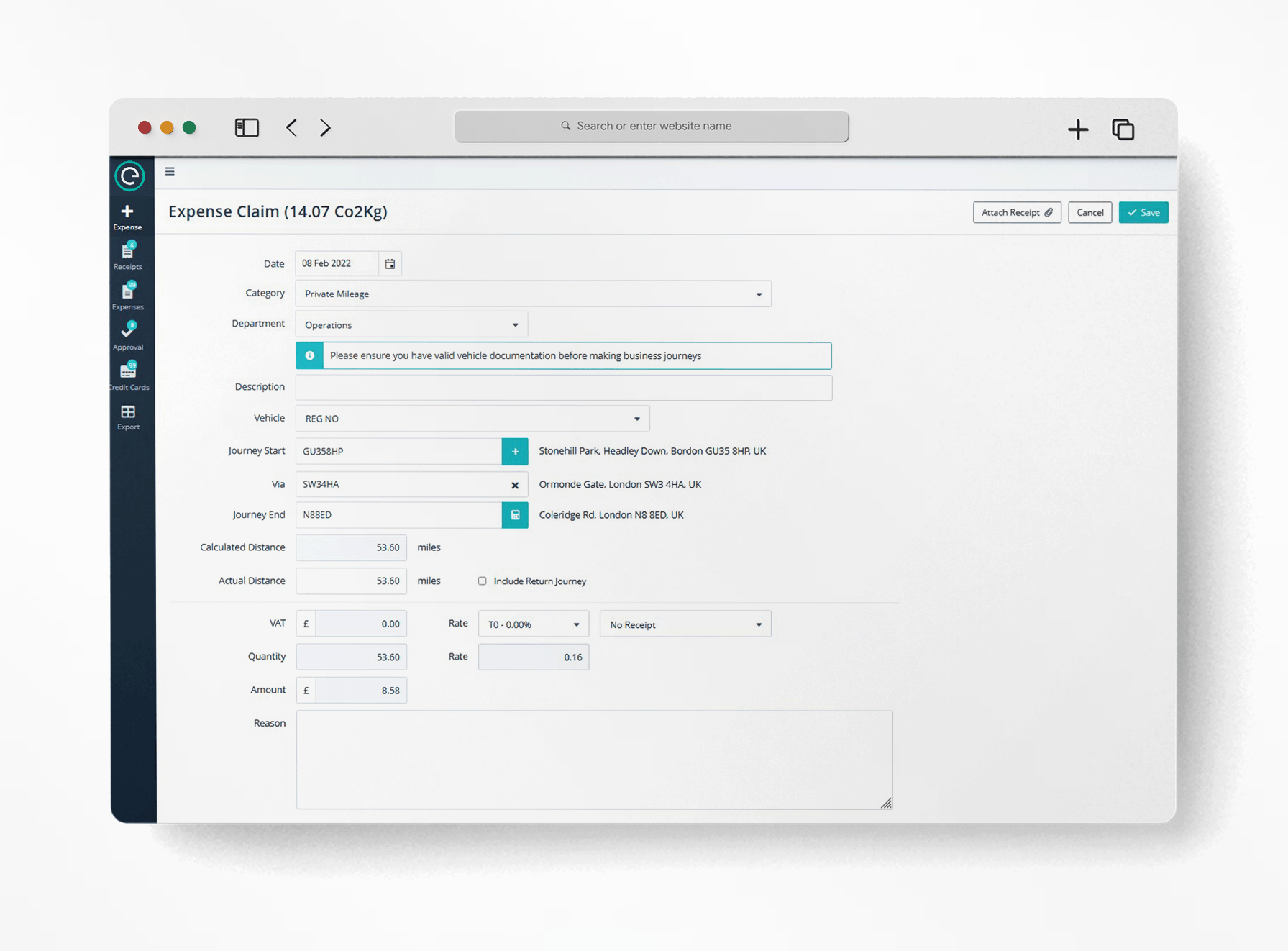

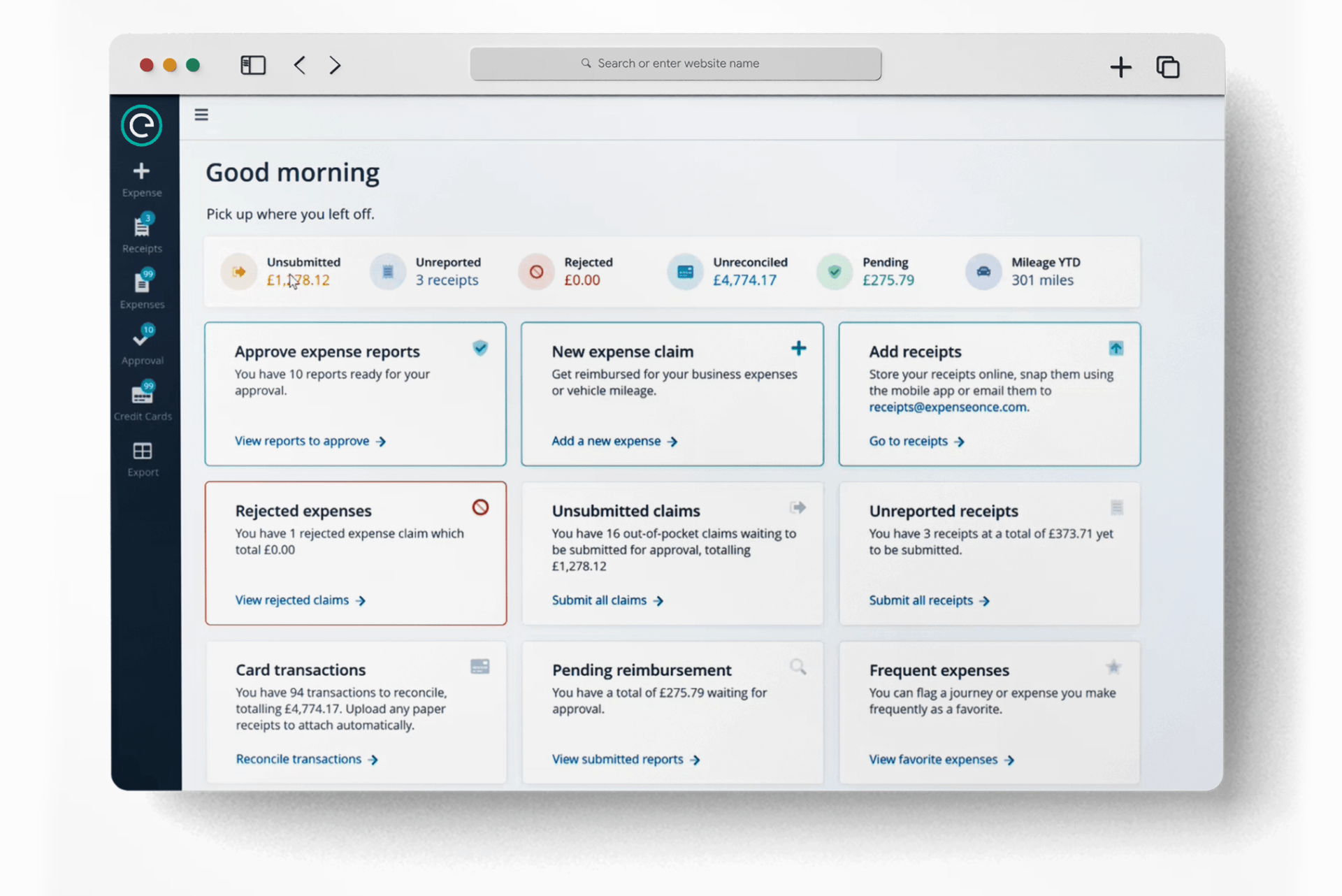

Solution: A modern expense management platform automates the expense tracking process, allowing employees to quickly and easily enter expense data into a central system. This system can then automatically process and categorise expenses, saving time and improving accuracy.

Manual Expense Tracking is Prone to Errors

Manual expense tracking is inherently prone to errors, whether from mistakes in data entry or lost receipts. This can result in inaccurate expense reports and cause delays in reimbursement or approval processes. Additionally, manual tracking makes it difficult to identify fraudulent or erroneous expenses, leaving your business vulnerable to financial losses.

Solution: A modern expense management platform can help minimise errors by automating the data entry process and validating expense information against pre-defined rules. This system can make flagging suspicious expenses much easier, alerting administrators to potential issues and thus improving accuracy and reducing the risk of fraud.

Manual Expense Tracking Limits Visibility

Manually tracking expenses in spreadsheets or paper forms makes it difficult to gain a complete and accurate picture of your business’s spending patterns. Without real-time visibility into expense data, it can be challenging to identify trends, track spending, and make informed decisions about budgeting and forecasting.

Solution: A modern expense management platform provides real-time visibility into expense data, allowing businesses to make informed decisions about spending. With customizable reporting and analytics, businesses can gain insights into spending habits, identify cost-saving opportunities, and optimise their overall financial performance.

Manual Expense Tracking Delays Reimbursement and Approval Processes

Manually tracking expenses can cause significant delays in reimbursement and approval processes, leading to frustration and dissatisfaction among employees. With a manual process, employees may need to wait several days or even weeks to receive reimbursement, which can negatively impact morale and productivity.

Solution: A modern expense management platform streamlines the reimbursement and approval process, allowing employees to submit expenses quickly and easily, and administrators to approve or reject expenses with just a few clicks. This can significantly reduce the time and resources required for expense reimbursement and improve employee satisfaction.

In conclusion, manual expense tracking can be a significant hindrance to a business’s success, resulting in time-consuming processes, errors, limited visibility, and delays in reimbursement and approval. By implementing a modern expense management platform, businesses can automate the expense tracking process, improve accuracy, gain real-time visibility, and streamline the reimbursement and approval process, ultimately leading to improved financial performance and overall business success.

See the solution in action by signing up for our webinar, taking place on 23rd March 2023. In this live product demo, we’ll show you how Capture Expense allows your people to raise, submit and approve expenses at any time, from any location and streamlines the way your organisation manages spend. Sign up here.