Business travel comes with its fair share of perks—new destinations, fresh opportunities, and a break from the usual routine. But once the trip’s over, the paperwork begins… and no one enjoys wrestling with receipts. That’s where per diems come in. This handy system offers a simple, predictable way to cover employee travel expenses like meals, transport, and accommodation—without the admin headache. Let’s take a look at what per diem really means, a real-world example, and the rates for 2025.

What does per diem mean?

Per diem is a daily allowance provided to employees to cover expenses such as meals, accommodation, and travel costs when they’re away on business. It simplifies the reimbursement process by offering a fixed amount rather than requiring itemised receipts for each expense. Per diem rates are often regulated by government guidelines and can vary depending on whether the travel is domestic or international.

What are the per diem rates for 2025?

Here are the UK per diem rates for 2025, based on HMRC’s meal allowance guidelines:

| Minimum journey time | Maximum allowance |

| One meal and up to 5 hours of travel | £5 |

| Two meals and 5–10 hours of travel | £10 |

| Three meals and 10–12 hours of travel | £15 |

| 24-hour period | £25 |

You can claim a meal allowance if

- You’re travelling for work – either as part of your job or to a temporary workplace, not just commuting as usual.

- You’re away from your normal place of work or home for more than 5 or 10 continuous hours.

- You’ve bought a meal (food or drink) during your journey and have evidence of the expense (like a receipt or card statement).

You can’t claim a meal allowance if

- You didn’t actually buy a meal or drink during your trip.

- The meal didn’t create any extra cost – for example, if it was something you would’ve eaten at home anyway.

- You had the meal at home before leaving or after returning.

- The meal was provided for free as part of a training course, event, or conference.

- You received a free meal on a train or plane, included in the ticket.

- The meal included alcohol (that’s not covered under HMRC’s rules).

A real-world scenario

Meet Peter. He works for a tech consultancy based in Manchester and is heading to London for a two-day client workshop. His company has opted to use per diem allowances to make travel expenses easier for everyone.

Instead of collecting every receipt for coffees, lunches, and taxi rides, Peter receives a fixed daily allowance based on HMRC’s approved rates (see above). On day one, he leaves home at 7am and doesn’t return until after 9pm, so he qualifies for the £25 meal allowance. The company already booked and paid for his hotel and train in advance using the company card—so his per diem just needs to cover meals, snacks, and the odd travel cost like a Tube ride.

Peter grabs breakfast at the station, picks up lunch near the client site, and finishes the day with dinner close to his hotel. He doesn’t need to keep receipts for each meal because the allowance is a flat rate, but he does make a note of where and when he ate, just in case HR asks for evidence the meals were during the business trip.

He avoids alcohol (as that’s not covered under HMRC rules) and doesn’t try to claim for the theatre ticket he bought for the evening—he knows that’s a personal expense.

The next day is a shorter one, so he qualifies for the £10 meal allowance before heading back north.

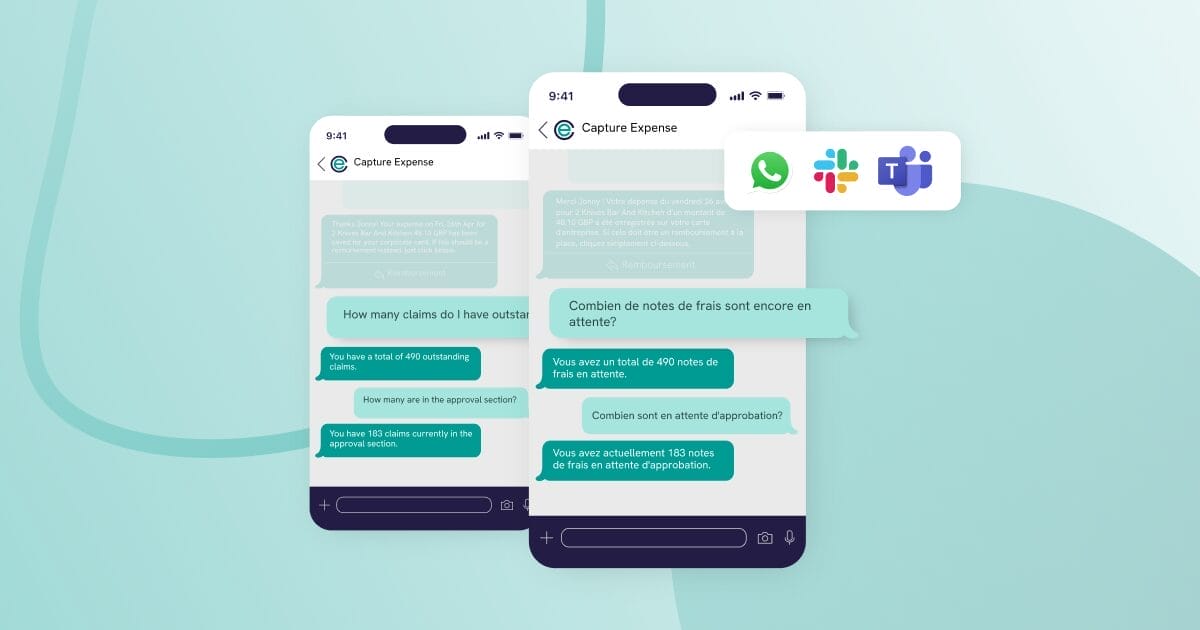

Are you looking to reduce admin, speed up reimbursements, and stay fully HMRC compliant?

Managing travel expenses and subsistence allowances can quickly become a hassle—especially when you’re juggling receipts, HMRC rules, and the risk of duplicate claims. That’s where Capture Expense comes in. It helps you streamline the whole process by automating approvals, flagging suspicious claims, and making sure your per diem rates are applied correctly and consistently. Book a personalised demo today to see Capture Expense in action.